If you ask the people who run America’s electric utilities what keeps them up at night, a surprising number will say solar power. Specifically, rooftop solar.

That seems bizarre at first. Solar power provides just 0.4 percent of electricity in the United States — a minuscule amount. Why would anyone care?

But utilities see things differently. As solar technology gets dramatically cheaper, tens of thousands of Americans are putting photovoltaic panels up on their roofs, generating their own power. At the same time, 43 states and Washington DC have “net metering” laws that allow solar-powered households to sell their excess electricity back to the grid at retail prices.

That’s a genuine problem for utilities. All these solar households are now buying less and less electricity, but the utilities still have to manage the costs of connecting them to the grid. Indeed, a new study from Lawrence Berkeley National Laboratory argues that, without policy changes, this trend could soon put utilities in dire financial straits. If rooftop solar were to grab 10 percent of the market over the next decade, utility earnings could decline as much as 41 percent.

To avoid that fate, many utilities are now pushing for reforms that would at least slow the breakneck growth of rooftop solar — say, by scaling back those “net metering” laws. And that’s opened up a war with many fronts. There are solar advocates who’d prefer not to see any changes. There are conservative groups like the American Legislative Exchange Council (ALEC) pushing to pare back solar subsidies. And there are even Tea Party groups now defending solar. Meanwhile, state regulators are struggling to find compromises that would both allow solar to expand but also ensure that there’s enough money to maintain the existing grid.

Battles over solar are now raging in more than a dozen states — from Arizona to Utah to Wisconsin to Georgia. (They’re also flaring up abroad, in countries like Germany and Australia). And the debate raises some legitimately hard questions about how best to deal with a new energy technology. Here’s a broad overview:

How cheap solar could lead to a utility “death spiral”

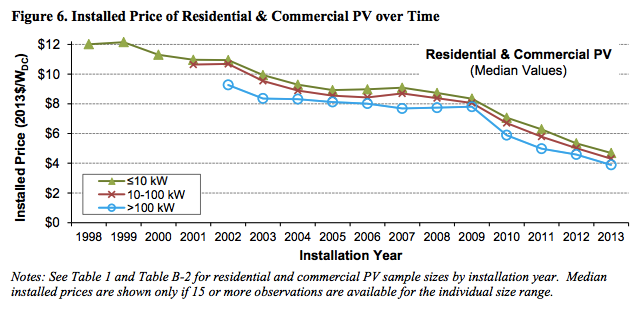

Source: Lawrence Berkeley National Laboratory

Solar panels are still a niche product. But the cost of solar rooftop systems has been plummeting in recent years (see chart). Firms like SolarCity will now install solar systems at no upfront cost to customers who can then make monthly payments. Plus, there’s a 30 percent federal tax credit for residential solar systems until the end of 2016.

So even though solar provides just 0.4 percent of America’s electricity, it’s growing at a shocking rate. Rooftop solar generation has roughly tripled since 2010. By some estimates, a new solar system is installed every four minutes in the United States.

To electric utilities, this poses a dilemma. As rooftop solar becomes more popular, people will buy less and less electricity from their local power company. But utilities still have plenty of fixed costs for things like maintaining the grid. So, in response, those utilities will eventually have to raise rates on everyone else. Trouble is, those higher electricity rates could spur even more people to install their own solar rooftop panels to save money. Cue the death spiral.

Sound far-fetched? This was the doomsday scenario laid out by the Edison Electric Institute, an industry trade group, back in January 2013. Even a relatively modest increase in rooftop solar power could cause havoc. David Crane, CEO of NRG Energy, has called these trends “a mortal threat to the existing utility system.” (Some utilities also have their own solar plants, but that doesn’t pose a threat to their business model.)

One recent study from Lawrence Berkeley National Laboratory found that some utilities could face serious financial trouble in the coming decade. Distributed solar now makes up nearly 2 percent of retail sales in some areas. If solar penetration reaches just 2.5 percent, shareholder earnings for some utilities could fall an estimated 4 percent. (Electricity prices, meanwhile, would rise just 0.1 to 0.2 percent.)

That’s just the beginning. If the penetration of distributed solar reached as high as 10 percent — an admittedly aggressive scenario — a typical utility in the Southwest could see its earnings drop 5 percent to 13 percent, while a typical utility in the Northeast could see its earnings decline 6 percent to 41 percent. This is similar to what’s happened in Germany, where distributed solar has halved the market value of some utilities.

The LBNL study did argue that there are policies that might help utilities recoup their lost revenues. Some states are trying to modify regulations so that utility profits are no longer wholly dependent on how many power plants they build and how much electricity they sell — a process known as “decoupling.” But whether this softens the blow really depends on the fine details.

“Utilities are now pushing to scale back solar subsidies!”

The potential disruptions caused by solar power have triggered a number of fierce policy disputes at the state level.

Comments