- Canada’s federal government is looking to become a global leader in solar manufacturing, among other industries, through a series of targeted investments in the country’s mineral value chain.

- Dubbed the Critical Minerals Strategy, the initiative looks to capitalize on the "generational opportunity" of supplying like-minded nations with the critical building blocks of a future clean economy.

- But does this strategy have the support and political will to make the country a new solar manufacturing powerhouse?

Canada’s federal Liberals have unveiled the nation’s first Critical Minerals Strategy, which seeks to take advantage of a “generational opportunity” by positioning the country as a powerhouse in the supply of cleantech materials through billions of dollars in targeted investments and reforms.

The strategy lays out a series of new incentives covering aspects of the mineral value chain, including $47.7 million for mineral R&D across Canada’s research laboratories, $144.4 million to support the deployment of innovative mining technologies, and most notably, a 30% critical mineral exploration tax credit. This last incentive applies to copper, uranium, lithium, cobalt, nickel, graphite, vanadium, and rare earth elements.

The Critical Minerals Strategy highlights the importance of streamlining mining assessments, as current regulatory processes can cause delays lasting anywhere from 5-25 years.

“For major development projects where both federal and provincial impact or environmental assessments are required, the Government of Canada is committed to meeting the objective of one project, one assessment in its review of projects by working with other jurisdictions to reduce duplication and increase efficiency and certainty in the regulatory process,” the strategy reads.

Minister Wilkinson also spoke passionately about the matter, stating, “it cannot take us 12 to 15 years to open a mine in this country. Not if we want to achieve our climate goals.”

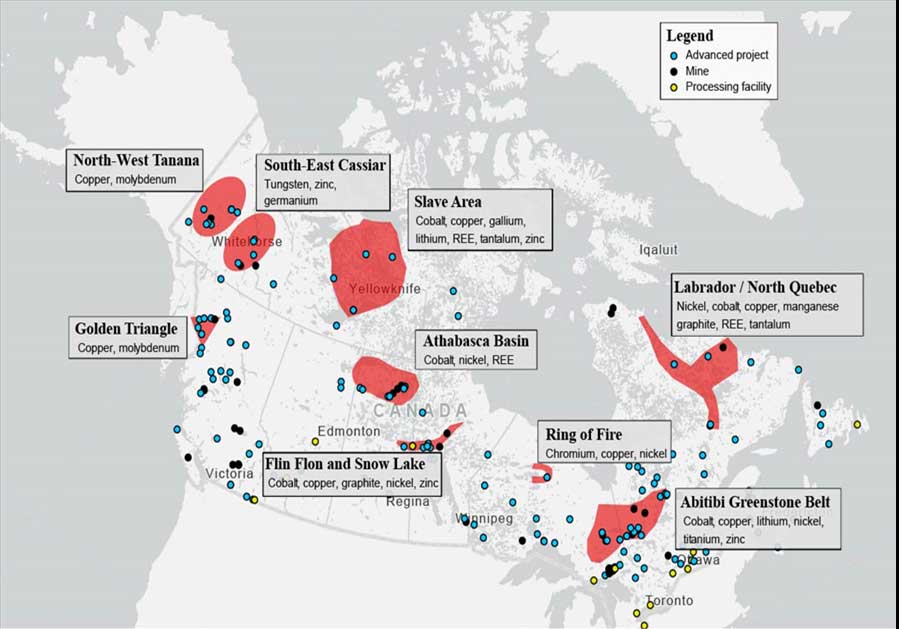

A map of Canada outlines major regions showing which critical minerals can be found where. This includes advanced projects, mines, and processing facilities. (Canadian Government)

Critical minerals play an essential role in various net-zero technologies, from solar panels and wind turbines to battery storage assets and nuclear plants. And as Canada is the only Western nation with an abundance of cobalt, graphite, lithium, nickel, and indium, there’s a massive opportunity for the country to play a dominant role in supplying ESG-friendly G7 nations with the critical building blocks of the clean economy.

With “non-like-minded “countries currently controlling most of the exploration, extraction, and processing of key minerals, Canada’s new strategy warns of potential shortages by way of geopolitical leveraging. This is similar to what the country’s European allies are experiencing on account of the ongoing conflict with Russia.

Canada has recently cracked down on foreign-owned mineral companies, with Innovation Minister Francois-Philippe Champagne ordering three Chinese companies to sell their interests in Canadian mining firms. This order came less than a week after Canada announced it would limit foreign state-owned companies’ involvement in the Canadian mining industry and plans to set a higher bar regarding whether an investment protects Canada’s interests.

“While Canada continues to welcome foreign direct investment, we will act decisively when investments threaten our national security and our critical minerals supply chain, both at home and abroad,” said Champagne.

Speaking in Vancouver during the unveiling of the new initiative, Natural Resources Minister Jonatha Wilkinson highlighted the importance of Canada utilizing its abundance of natural wealth. “Simply put, there is no green energy transition without critical minerals,” he said.

It will also be necessary for substantial investments to be made in transportation infrastructure and strategic clean energy projects to access remote mineral deposits while improving supply chain resiliency. As off-grid mining operations depend heavily on dirty fossil fuels like diesel, establishing solar and wind-heavy microgrids will be essential in aligning mining operations with net-zero targets and driving improved competitiveness.

The Critical Mineral Strategy outlines the cleantech industries with the highest potential for value chain integration across Canada. The notable highlights are solar panel manufacturing and zero-emission vehicle (ZEV) production.

With federal leadership and a clear policy blueprint, the Liberals are set to deliver robust industrial ecosystems, much to the benefit of Canadian industry.

The Mining Association of Canada and other industry groups have applauded the Critical Minerals Strategy as a logical step forward for the country’s economy.

I think this sends a strong signal to the world that Canada is very focused and committed to attracting investment [in] critical minerals,” said Pierre Gratton, the association’s president.

However, some environmental groups allege the Liberal approach fails to meet the scale of today’s challenges. Mining Watch, an extraction-focused federally registered non-profit, has accused the Critical Minerals Strategy of being an “adaptation of business as usual.”

This criticism represents a fundamental tension between environmentalist groups, which overwhelmingly support renewable energy but often adopt NIMBY attitudes regarding large-scale resource extraction projects, which the mining industry epitomizes.

However, the reality of the situation is that meeting the challenge of net-zero emissions will require a massive amount of minerals and other natural resources. Increasing Canada’s mining capacity as a major mineral hub is necessary to prevent material shortages in solar and other industries, which would do little than spike prices and hamper emission reduction efforts.

Environmentalists would be better suited to promoting mitigation and remediation strategies for mineral projects while focusing on opposing truly harmful developments to biodiversity and the climate, like deep-sea mining.

Between its vast resource wealth, reasonably strong (though still in need of improvement) ESG performance standards, longstanding and diverse mining expertise, advanced manufacturing sector, and abundant clean energy, Canada’s optimally positioned to supply its domestic industry and allies with the abundant mineral resources and technologies needed to deliver on the renewable energy revolution. Despite the difficult year, Canadian solar and other cleantech professionals have reason to celebrate as 2022 comes to a close.

Comments