Corporations are becoming increasingly focused on lowering and hedging their electricity costs and improving their sustainability practices. One way that corporations are accomplishing these goals is by purchasing electricity or by hedging electricity prices through solar and wind power purchase agreements (PPA).

Corporations, by entering into PPAs with solar and wind project developers, are becoming more inclined to purchase renewable energy through long-term, fixed-price contracts, which in many jurisdictions are cheaper than their current cost of electricity and which further supports their corporate sustainability goals.

The PPA structure allows corporations to enter into agreements with renewable energy project developers that are building on-site or off-site renewable energy projects. With on-site PPAs, corporations purchase electricity generated from a solar system either by owning the system, leasing the system, or by utilizing a third-party ownership PPA structure.

All three mechanisms provide generation on-site, physically delivering power provided by the panels to their facility.

With specific emphasis on the PPA structure, PPAs allow corporations to avoid upfront and operational costs, as well as maintenance and performance risks that can be associated with owning the system and providing the corporation with an agreed upon electricity rate usually for a 10- to 20-year period.

Yet, there are many corporations with high sustainability goals that want to lower their energy costs by purchasing renewable energy, but who have limited or no options for on-site generation. There are also corporations whose on-site solar generation capacity does not cover their total energy load profile and they must look elsewhere for renewable energy generation to meet these needs.

This is the case for Walmart, as described by their Director of Sustainability Communications, Micah Ragland: “Our renewable energy aspiration cannot be achieved with on-site generation alone. This is why Walmart’s renewable energy strategy includes procuring power from energy providers whose operations, typically utility-scale wind and solar farms, sit far from the facilities that they supply. As of FY2017, we had nine large agreements supplying our operations in Mexico, the U.S. and the U.K., comprising 75 percent of our renewable portfolio.”

Off-site PPAs therefore present corporations with another viable option. The American Council on Renewable Energy (ACORE) has found that “corporate offsite renewable energy has more than doubled every year since 2012 and is projected to grow to more than 60 GW by 2030.” Most off-site PPAs are structured through a contract for differences (CfD).

According to Alex Leff, a renewable energy project finance attorney with the law firm Sive, Paget & Riesel, P.C.:

“CfDs, or ‘virtual PPAs,’ act as an electric power price hedge. In these transactions, a corporate off-taker and the project developer agree upon a fixed PPA rate for the electric power generated from an off-site renewable energy project. The electric power generated from the off-site project is then sold on a merchant basis into the wholesale electricity markets. Any variation between the wholesale electricity rate and the fixed PPA rate are accounted for at the end of each settlement period and either paid to the corporation if the wholesale electric power rate exceeds the fixed PPA rate or paid to the project developer if the wholesale electric power rate is less than the fixed PPA rate. Importantly, the corporation is traditionally allocated the renewable energy credits attributable to the renewable energy project.”

Stadiums, such as the Verizon Center in Washington D.C., have benefitted from off-site power purchase agreements with solar project developers.

Dr. Louis J Hutchinson III, VP and chief revenue officer for Washington Gas Light Company (WGL), which is the parent company of Washington Gas, a diverse clean and efficient energy solutions corporation, believes “it’s all about creating an innovative solution that allows solar to scale — a good example is the recently announced transaction with Monumental Sports & Entertainment, home of Verizon Center for D.C.’s Wizards, Mystics, and other sports and entertainment. Unable to do solar on-site, they still found a way.

Through close collaboration, WGL Energy leveraged a diverse energy portfolio and experience in offering tailored renewable energy options. With limited space to install on-site, we pioneered a highly innovative solution to deliver off-site renewable energy from a solar facility in Maryland.”

Corporate PPAs are prime for widespread adoption due to several different factors. First, the investment tax credit (ITC) will begin to step down in the coming years and therefore should be utilized soon.

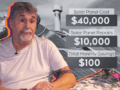

Currently, the credit is for 30 percent of qualified expenditures related to the project through 2019, but the ITC is scheduled to step down to as low as 10 percent by 2022. In addition, electricity pricing for solar projects are the same as or more competitive than electricity prices for fossil fuel projects, resulting in limited electricity price risk involved. On-site or off-site PPAs allow for the buyer to hedge electricity costs for 10 to 20 years, which will protect against the costs of electricity that are likely to increase.

Finally, the cost of solar is decreasing substantially, as seen through lower hardware costs and improvements in technology.

PPAs, whether on-site or off-site, will be a way in which to provide clean energy and competitive pricing to all interested corporations. Now is a great opportunity for companies to look into off-site corporate PPAs. The major reasons that off-site corporate PPAs are popular are because they allow companies to hedge and lower their electricity costs and meet their sustainability goals, which could be limited by on-site renewable generation.

Off-site renewable energy corporate PPAs will be one of the primary ways for companies to reach their goal of having 100 percent of their electricity usage being sourced through renewable energy.

Comments