- Sixteen large solar projects totaling 10.4 MW are set to come online in the second half of 2025—more than six times the utility-scale capacity completed in 2024.

- Nova Scotia Power forecasts 25 MW of community solar annually from 2026 to 2029, adding up to 100 MW of new solar capacity.

- Rising peak demand and coal retirements are pushing the province to invest in battery storage, fast-acting gas turbines, and firm capacity to maintain grid reliability.

Nova Scotia Power’s 2025 10-Year System Outlook outlines a sharp rise in solar development across the province.

As of June 2025, 16 large solar projects—each over 100 kW—are in the advanced-stage interconnection queue. Together, they represent 10.4 MW of new capacity expected to come online by the end of the year. For comparison, all of 2024 saw only 1.5 MW of large solar installations completed.

While these figures don’t include smaller residential or commercial installations, they mark a significant jump in utility-scale solar progress for a province that has historically lagged in solar deployment.

In addition, the utility projects that an additional 25 MW of community solar will come online annually from 2026 through 2029, adding 100 MW of solar capacity over four years. These systems will likely play a key role in meeting the province’s 80% renewable energy target by 2030.

Forecast and Trends

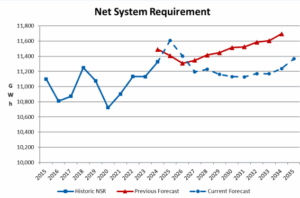

Historical and Predicted Annual Net System Requirement (Nova Scotia Energy Board 2025 10-Year System Outlook)

Despite growing electrification and population, Nova Scotia’s net system requirement (NSR) is projected to decline slightly over the next decade, with an average annual decrease of 0.2%. This counterintuitive trend is attributed to expanding behind-the-meter solar generation, increased participation in the Renewable to Retail (RTR) market, and robust demand-side management (DSM) efforts.

That said, peak demand is expected to rise steadily—by 1.1% annually—driven by winter heating and EV adoption. This underscores the need for reliable firm capacity, even as energy efficiency and local generation reduce overall energy consumption.

New Capacity, Retirements

To maintain grid balance during this transition, the province is investing in a mix of fast-acting gas generation and battery energy storage. A total of 600 MW of fast-acting capacity is slated for development, although delays in procurement may push some projects beyond 2027.

Meanwhile, coal retirements continue, including those of the Trenton, Lingan, Point Tupper, and Point Aconi units—all of which are expected to shut down or convert to alternative fuels by 2030.

This changing generation mix will also demand upgrades in transmission infrastructure and more robust interconnection requirements for solar and battery developers.

Broader Shift

The solar expansion fits into a wider transformation. Nova Scotia is working to meet stringent provincial and federal regulations—targeting 80% renewable energy by 2030 and net-zero electricity by 2050. According to the report, 40.5% of Nova Scotia Power’s 2024 energy sales were from renewable sources. With the addition of new wind and solar procurements, as well as strengthened interprovincial transmission, the province is on track to meet its goals.

But success depends on timing. If new resources face further delays, Nova Scotia risks falling short of both reliability and regulatory requirements.

Insight

Nova Scotia’s solar rollout has long been criticized for its sluggish pace.

This new system outlook is the strongest indication yet that the province is finally preparing to scale solar—not just in rhetoric, but in megawatts. The next 18 months will test whether planning aligns with execution, and whether Nova Scotia can establish itself as a serious player in clean energy in Atlantic Canada.

As utilities across Canada retool for a decarbonized grid, Nova Scotia’s solar strategy may offer a compelling model—or a cautionary tale.

Comments