In a recent SEC filing, Tesla revealed it had purchased USD 1.5 billion in bitcoin. The company also said it would start accepting the popular cryptocurrency as a formal form of payment for its electric vehicles.

Bitcoin surged 15 percent on account of the news exceeding USD 44,000 for the first time.

The fact that corporations and individuals, alike, are investing in bitcoin is not new — one could even argue that it’s a smart idea.

Cryptocurrency is here to stay and this move by Tesla only goes to certify that as a fact. So why is this a problem for Tesla?

Well, it all comes down to energy use.

Bitcoin’s energy appetite is fused into its foundations.

Since no central bank or authority governs the currency, the bitcoin network regulates itself through a distributed accounting system known as Blockchain.

It’s important to note that bitcoin is the most popular and widely used cryptocurrency. It’s actually the currency for which blockchain technology was invented.

Each new bitcoin requires the creation of a new blockchain that miners validate. The miner is paid in bitcoin for this validation.

The validation process is simple, every 10 minutes, a miner uses computing power and special software to solve a mathematical puzzle — and is rewarded with some bitcoins. Then, a new puzzle is generated, and the whole process starts over again.

This computing power miners use is reportedly extensive and consumes a lot of energy.

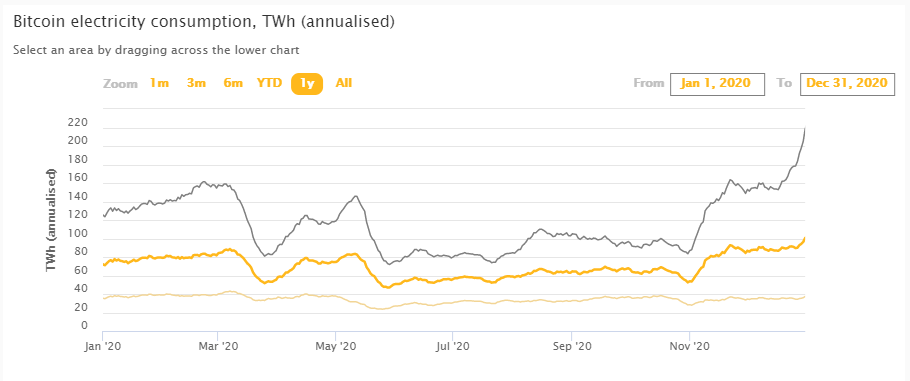

If the 2020 data indicated in this article is correct, that means it takes 72,000 GW (or 72 Terawatts) of power to mine a single Bitcoin within 10 minutes, regardless of the number of miners.

Cambridge bitcoin electricity consumption index. (University of Cambridge)

The rewards may be virtual, but the energy cost is very real, and this results in the production of tons of greenhouse gas emissions every year. Climate change is caused by the increase in concentrations of greenhouse gases in the atmosphere.

While some publications have claimed that the majority of the electricity used by bitcoin actually comes from clean sources, like wind, solar, and hydropower, some analysts are skeptical, since it contradicts other assessments of where bitcoin miners get their energy.

According to Morgan Stanley data, the bitcoin network consumes as much electricity as 2 million U.S. homes.

Many people consider Tesla a standard-bearer for the broader climate technology movement.

This momentum has helped grow the company’s reputation and popularity among the sustainable energy-conscious demographic — a lot of whom are probably part of the company’s huge customer base.

Tesla’s bet to purchase bitcoin and its decision to start accepting the cryptocurrency as a method of payment could damage its climate-hero type reputation.

But then again, the company’s CEO Elon Musk has proven time and time again, that you should never bet against the company. At least not anytime soon.

Comments