- The 30% residential solar tax credit will end on December 31, 2025, nearly a decade earlier than planned under the Inflation Reduction Act.

- The change could lead to over 200,000 job losses in the residential solar sector and make solar less accessible for middle-income homeowners.

- With electricity demand projected to surge 130% by 2030, eliminating incentives for rooftop solar could increase grid strain and utility bills.

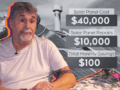

The U.S. residential solar sector is bracing for turmoil after President Donald Trump’s so-called “Big Beautiful Bill” was signed into law, effectively gutting the 30% federal tax credit for homeowners who install rooftop solar systems.

Once a cornerstone of clean energy policy, the residential credit under Section 25D of the tax code will now vanish at the end of 2025—nearly a decade earlier than scheduled under the Inflation Reduction Act.

Originally set to run through 2034, the incentive has helped millions of Americans afford solar systems that reduce their utility bills and decrease their reliance on fossil fuels.

However, with the new law, homeowners now have a narrow window—until December 31, 2025—to claim the credit, which is worth roughly $9,000 for an average 11-kilowatt system.

Who This Hurts

Solar panels are installed on the rooftop of a home in a new housing project in Sacramento, California. (Rich Pedroncelli/The Associated Press)

The sudden policy shift could price out tens of thousands of middle-income families who depend on the tax credit to make solar feasible.

According to a Lawrence Berkeley National Laboratory study, nearly 44% of solar adopters in 2023 had household incomes under $100,000.

“This is going to devastate working families,” said Will Etheridge, CEO of Southern Energy Management in North Carolina, who warned his 190 employees that layoffs are imminent. “It’s a bait and switch.”

His sentiment is echoed across the industry. A recent EnergySage survey of over 150 solar installers found that over 92% expect serious harm to their businesses, with nearly 6% planning to exit the market entirely.

Commercial Projects

A view of some of the 749,088 solar panels at the California Valley Solar Farm near. (SFGate)

Residential solar credits are being phased out quickly, but commercial and utility-scale solar projects governed under Section 48E will retain their credits until at least 2028.

However, new content requirements are set to increase: by 2026, 40% of system components must be made in the U.S., rising to 60% by 2030. This gives third-party-owned systems, such as leases and power purchase agreements (PPAs), a temporary advantage.

It’s important to note that the benefits of these models primarily accrue to companies rather than consumers, which means homeowners may experience reduced long-term savings.

Rising Costs Loom

The timing of the rollback is particularly troubling. U.S. electricity demand is projected to increase by 130% by 2030, driven in part by the growth of AI data centers and the trend toward electrification. Utilities are racing to expand generation and grid infrastructure—costs that ultimately fall on ratepayers.

Rooftop solar, often deployed more quickly than centralized infrastructure, could help alleviate grid pressure. Without it, analysts warn, the U.S. faces a higher risk of rolling blackouts, price spikes, and stalled efforts to reduce emissions.

Energy prices are already on the rise. Analysts project that typical households could see bills climb by over $140 annually. Solar offered a hedge. Without the federal tax credit, the barrier to entry just got steeper.

Impact on Jobs

The Solar Energy Industries Association (SEIA) estimates the repeal will cost the residential solar sector over 60,000 jobs by the end of this year and nearly 200,000 by the end of 2026.

That’s a heavy blow for an industry that has added jobs five times faster than the overall U.S. economy in recent years.

Clean energy companies across the country have already reported bankruptcies, project cancellations, and hiring freezes. The North Carolina-based NC Solar Now, which relies on residential projects for 85% of its business, expects to lay off half its workforce.

“This bill took the savings from average Americans and handed it back to big utilities,” said Karl Stupka, the company’s president.

Insight: Not Dead, But Wounded

Rooftop solar isn’t gone—but without the federal credit, it becomes a harder sell. Payback periods will lengthen from 8–10 years to possibly 15–20, depending on local electricity rates and state-level support. Prices have dropped to $2.50 per watt, but time is running out.

For homeowners eyeing solar, the message is clear: If you want the credit, act fast.

For the industry, the law represents a retreat from two decades of bipartisan clean energy policy—and a warning shot to an economy still struggling to decarbonize at scale.

Comments