The United States has imposed some of the steepest tariffs in history on solar panels and components imported from Cambodia, Malaysia, Thailand, and Vietnam, following a year-long trade investigation.

The decision by the U.S. International Trade Commission (ITC) and Department of Commerce is intended to curb alleged dumping and transnational subsidies linked to Chinese-owned solar firms operating through Southeast Asia to skirt existing tariffs.

Tariffs Reach Up to 3,500%

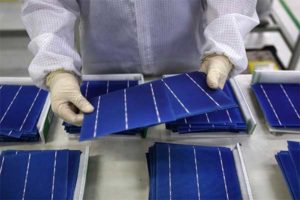

An employee performs a final inspection on solar cells on the production line at the Trina Solar Ltd. factory in Changzhou, Jiangsu Province, China in 2015. (CNN)

Tariffs on imports vary dramatically, with Cambodian manufacturers facing duties as high as 3,521%, while Vietnamese producers see up to 813%, and Thai firms up to 972%.

The measures follow findings that manufacturers were selling products below production cost with the help of foreign subsidies, harming U.S. industry competitiveness.

The move stems from an April 2024 petition by the American Alliance for Solar Manufacturing Trade Committee, which includes domestic firms like First Solar and international players such as Hanwha Qcells and REC Silicon.

The petition argued that Chinese-headquartered companies exploited Southeast Asia to avoid U.S. tariffs.

The ITC agreed, clearing the path for the U.S. Customs and Border Protection to begin collecting duties starting June 16, 2025.

Industry Reaction: Divided Interests

The Solar Energy Industries Association® is the national trade association of the U.S. solar energy industry, which now employs more than 250,000 Americans. Through advocacy and education, SEIA® is building a strong solar industry to power America.

Supporters of the tariffs, including Tim Brightbill, counsel to the trade alliance, argue the decision protects American manufacturers and restores fair market conditions.

“This cannot stand,” Brightbill said. “Our growing American industry now has the chance to compete fairly.”

But the decision has drawn criticism from major U.S. solar developers and clean energy groups.

Abigail Ross Hopper, president of the Solar Energy Industries Association (SEIA), warned that the tariffs will raise costs and choke the momentum in solar deployment. “U.S. solar cell manufacturing is growing, but not yet at scale,” she said, cautioning that import restrictions risk stalling progress.

Global Ramifications and Workforce Impact

Cambodia, one of the hardest hit, saw a nearly 100% drop in exports to the U.S. over the past year.

Analysts suggest smaller regional manufacturers will struggle to survive, unlike larger Chinese players who preemptively relocated to the U.S. or other markets.

In Malaysia, more than 5,000 workers are at risk of job loss due to shuttering operations.

Meanwhile, U.S. imports from Indonesia and Laos have skyrocketed, prompting concerns of trade rerouting and a wider oversupply crisis.

Strategic Gamble

While the tariffs aim to bolster U.S. manufacturing, they could also undermine affordability and disrupt solar project pipelines. Whether the move sparks a domestic manufacturing revival or prolongs global supply chain instability remains to be seen.

Comments