- Bankability stands as a cornerstone for commercial renewable energy projects, signaling their viability and financial promise to potential investors.

- Through a blend of project readiness, appealing financial structures, and a focus on sustainability, this article explores how projects can attract the necessary investment to become a reality.

- Let's review the five pillars essential to ensuring that a renewable energy project is bankable and successful.

Bankability is key in the world of commercial renewable energy projects. It sends potential investors this message: “this project is worth your time and money.”

At its core, bankability indicates whether or not a project is practical, feasible and financially promising, apart from being visionary. Bankability provides solid evidence that an investment will lead to tangible result and profitability. This concept is critical in bridging the gap between innovative solutions and the financial support they require to materialise.

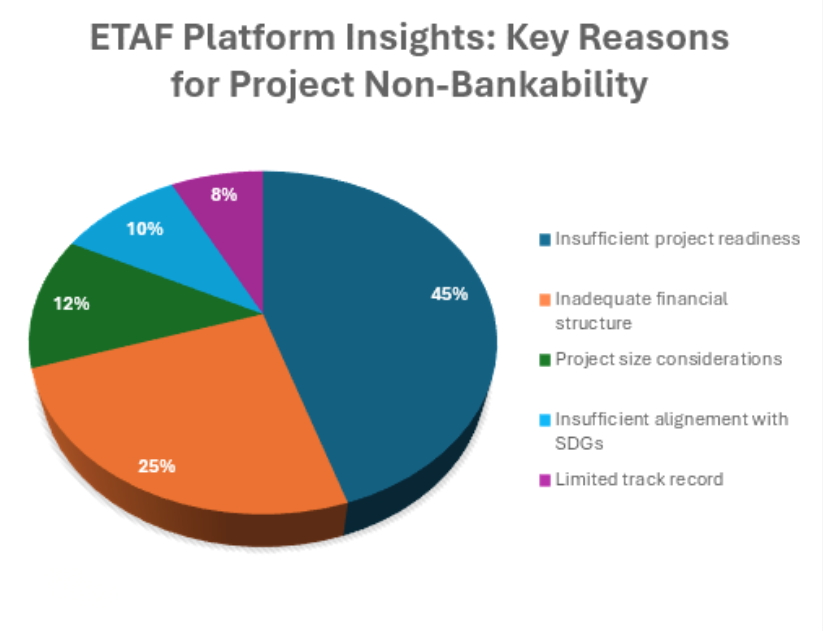

Drawing from diverse experiences in the renewables sector, including key insights from the International Renewable Energy Agency (IRENA)’s Energy Transition Accelerator Financing (ETAF) platform, this article elucidates essential factors that appeal to investors and identifies pitfalls that can hold them back from investing. Below are five pillars that determine a project’s bankability. They include steps towards securing investment and essential strategies for operational success.

1. Project Readiness and Comprehensive Planning

Project readiness indicates that a project has moved beyond conceptual ideas and is ready for financial discussions. This phase involves selecting technology that is both viable and proven, scaled to the project’s needs. Initial steps focus on conducting feasibility studies that cover technical, financial and legal aspects.

These studies assess commercial viability, grid integration, potential energy production, and environmental and social impacts, thereby affirming operational readiness. Subsequent planning includes engineering, procurement, and construction (EPC), operations and maintenance (O&M), as well as securing reliable equipment suppliers.

Aleksandar Georgiev/E+ (Getty Images)

Clear permitting strategies and vital agreements, like interconnection and land agreements, underscore a project’s readiness and are crucial to financiers. ETAF data reveals that 45% of projects submitted to financing considerations are rejected for their low level of readiness.

Project size is also key. It is better to bundle small projects, as smaller projects can struggle to attract financing due to the significant fixed costs associated with transaction and due diligence processes. Bundling them will enhance their appeal to financiers, and the savings realised through economies of scale can be applied more broadly, potentially reducing economic challenges.

2. Offtake Attractiveness and Financial Structures

Securing investor’s confidence in renewables projects hinges on robust financial modelling and attractive offtake agreements. ETAF data shows that 25% of projects are rejected due to poor financial planning, half of which are rejected for low levels of equity, highlighting the importance of significant equity stakes in securing investment and aligning developer’s interests with project viability.

Equity provision signals the developer’s commitment to the project. Investors typically expect an 80/20 debt/equity ratio for traditional renewable technologies, while they will feel more comfortable with increased equity, for more complex, riskier technologies.

A detailed financial model which incorporates sensitivity analysis of projected revenue, costs and cash flow among others is essential for demonstrating a project’s viability and return of investment under diverse scenarios, further reassuring investors of the project’s ability to repay loans. Incorporating currency linkage and inflation adjustments is also important to protect investment against the risks of currency and inflation volatility.

Also critical to this process are reliable offtake arrangements, which provide a clear market path through mechanisms such as long-term Power Purchase Agreements (PPAs) with public utilities, merchant market structures, or corporate PPAs. Secure offtake agreements, particularly fixed take-or-pay contracts, offer a guaranteed revenue stream, enhancing the project’s appeal. Making sure that end-user prices are above PPA rates is crucial for financial attractiveness.

3. Experienced Project Team and Solid Track Record

The expertise and historical success of the project team are critical in securing investment for renewables projects. Proven track record, integrity and spotless global reputation of project sponsors in similar initiatives are non-negotiable, as they demonstrate an ability to overcome sector-specific challenges.

Renewable energy is useful energy that is collected from renewable resources, which are naturally replenished on a human timescale, including carbon neutral sources like sunlight, wind, rain, tides, waves, and geothermal heat. (hrui/Shutterstock)

Financial resilience is also key, with sponsors’ revenues ideally being double the total project capital expenditures (CAPEX), to signal financial stability. Those lacking such credentials may consider partnering with experienced entities to bolster their profile and attract financiers. It is essential for sponsors to steer clear of sanctions to avoid compromising projects with solid technical and financial underpinnings.

4. Proper Risk Analysis and Mitigation Plan

A thorough risk management plan is another key pillar of bankability. Specific project risks that need addressing include technology performance, construction delays and operational efficiency. Country risks might encompass regulatory changes, political instability and currency fluctuations.

Effective mitigation strategies often involve transferring some risks through insurance services and implementing robust management plans for others. The ETAF platform facilitates access to de-risking services, ensuring projects can adequately prepare for and mitigate these risks, thereby boosting their attractiveness to financiers.

5. Alignment with Sustainable Development Goals, ESG and Country’s Priorities

Aligning renewables projects with the Paris Agreements, UN Sustainable Development Goals (SDGs), and Environmental, Social, and Governance (ESG) frameworks is crucial. This alignment signifies the project’s substantial contribution to emissions reduction, local job creation, food security, and overall sustainable development. These non-financial factors are increasingly taken into consideration by financiers in deciding to take part in a project, marking a shift towards responsible and sustainable investments. Furthermore, projects that support host governments in meeting their Nationally Determined Contributions are more likely to receive all necessary governmental permits, facilitating project advancement.

Credit: IRENA

Conclusion

While government or non-commercial projects may differ in funding mechanisms – which may include sovereign guarantees – the importance of readiness, experienced management, and risk management is universal. To enhance project’s appeal and contribute to global sustainability efforts, developers and sponsors are also encouraged to adhere to sustainability goals principles.

For more discussion on renewables projects bankability, watch a session of IRENA’s 14th Assembly on 18 April 2024, titled ‘Accelerating the Development of Bankable Renewable Energy Projects’, to be livestreamed here.

—

This article was written by Haliru Audu – Associate Programme Officer, Renewable Energy Finance Markets and Adeline Duclos – Associate Programme Officer, Renewable Energy Project Finance both of IRENA.

It was originally published on the IRENA website.

Comments