- Alberta’s revised TIER system allows large emitters to invest in their own emissions-reduction projects instead of buying credits or paying fees.

- Critics warn the changes could lead to double-counting and flood the carbon offset market, devaluing credits and weakening accountability.

- The move could dampen investment in Alberta’s booming solar sector by increasing policy risk and undermining market confidence.

EDMONTON — Alberta’s government is rewriting the rules of industrial decarbonization—again.

In a move touted as pro-growth but derided by environmental groups and clean energy investors, Premier Danielle Smith announced sweeping changes to the province’s carbon pricing system, allowing emitters to meet their climate obligations through self-directed investments instead of paying into provincial funds or purchasing carbon credits.

From Carbon Pricing to Investment Credits

Under the updated Technology Innovation and Emissions Reduction (TIER) system, large industrial facilities, including oil sands producers and power generators, will now be able to reinvest in emissions-reduction projects at their own sites to meet compliance targets. The province argues this model fosters innovation, reduces regulatory burden, and ensures dollars stay within Alberta’s borders.

Smaller emitters, meanwhile, can opt out of the program altogether in 2025, a concession Smith says will help rural manufacturers save money and redirect funds toward operational improvements.

“This isn’t about avoiding climate goals, it’s about getting there smarter,” said Environment Minister Rebecca Schulz. “Alberta’s industries know what works best for them.”

Pushback From Climate and Clean Tech Groups

However, critics argue that the new model undermines one of the core tenets of carbon markets: accountability for results.

Both the Pembina Institute and the Canadian Climate Institute warned that the changes could lead to “double-counting,” where companies are credited for both investing in and later delivering emissions reductions, without having to prove the environmental outcomes.

The Canadian Renewable Energy Association (CanREA) went further, calling the changes a direct threat to Alberta’s clean energy investment climate.

“These reforms destabilize the credit market and break investor trust,” said Radha Rajagopalan, CanREA’s Alberta policy director. “TIER had become a rare pillar of policy certainty in Alberta’s volatile energy landscape. That’s now at risk.”

A Chilling Effect on Solar?

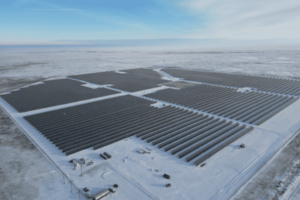

The Tilley Solar project consists of 70,000 photovoltaic panels. At its peak, the site will generate 280 full-time jobs and $20-million in labour income. (Tilley Solar Alberta/Supplied via The Globe And Mail)

The timing raises alarm bells.

Alberta has quietly become Canada’s solar capital, with more than 3,000 MW of capacity installed by 2024, thanks to investor-friendly market rules and confidence in emissions offset systems. But with TIER credits potentially devalued and carbon prices frozen at $95/tonne, defying federal benchmarks, developers say financing new solar and storage projects may become more difficult.

“This could mark the start of a cooling phase for Alberta solar,” warned one Calgary-based renewables investor, who requested anonymity. “The policy risk premium just went up.”

Federal Clash Looms

Ottawa could intervene. The federal Output-Based Pricing System sets a $110/tonne price for 2026. If Alberta’s new TIER structure is deemed non-compliant, the federal government could revoke its equivalency agreement, effectively forcing a return to federal oversight.

Smith’s government shows no signs of backing down. “We’ll do what’s best for Alberta,” she said. “And we’ll keep pushing Ottawa to get with the program.”

Analysis:

Alberta’s updated TIER system represents a calculated shift toward deregulated decarbonization. For oilsands and heavy industry, it’s a reprieve from rising costs. For renewables, it may be a retreat from stability. And for Ottawa, it’s a new headache in an already fragile climate policy patchwork.

Bottom line:

Alberta is betting that industry will effectively self-police emissions reductions. But without strong credit markets and rising carbon prices, that bet could cost the province its climate credibility and billions in renewable investment.

Comments