- Alberta’s renewable project pipeline shrank in 2024 for the first time, driven by policy shifts and a loss of investor confidence.

- Peer markets like Texas and South Australia are seeing continued growth thanks to stable, supportive regulatory frameworks.

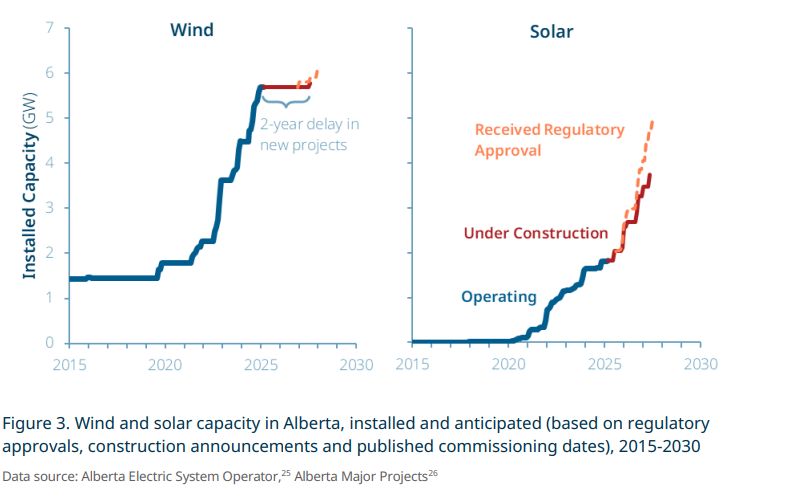

- Solar development is advancing in Alberta, but wind projects are stalling due to new land-use restrictions and transmission challenges.

Once hailed as Canada’s clean energy powerhouse, Alberta now finds itself in unfamiliar territory: declining investor confidence, regulatory headwinds, and a shrinking renewable project pipeline.

A new report by the Pembina Institute, Down But Not Out, offers a sobering look at how a once-booming renewables sector is now treading water. In 2024, for the first time on record, the Alberta Electric System Operator’s (AESO) queue of renewable energy projects contracted. This marks a major reversal from recent years. Between 2020 and 2024, Alberta accounted for 86% of all new wind, solar, and battery storage installations in Canada—totaling more than 6,000 megawatts.

This progress is now in jeopardy.

Globally, investment in renewables is accelerating.

According to the International Energy Agency, two-thirds of all energy investment in 2024 was directed toward clean energy projects. But Alberta is swimming against the current. While peer jurisdictions are adding capacity, Alberta saw more renewable energy projects cancelled than proposed in 2024, indicating a structural shift in investor sentiment.

Uncertainty Is the New Norm

Much of this shift can be traced back to a sudden moratorium imposed by the Alberta government in August 2023, which halted approvals for new wind, solar, hydroelectric, and geothermal projects. Though it was lifted in February 2024, it sent shockwaves through the development community.

Since then, a number of new policies have compounded the uncertainty: a ban on wind development within 35 kilometers of designated protected landscapes, new restrictions on agricultural land use, and the introduction of upfront recycling surcharges for renewable energy equipment—costs not levied on fossil fuel developers. These measures have introduced regulatory inconsistencies that investors perceive as discriminatory and unpredictable.

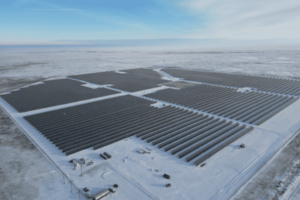

The Tilley Solar project consists of 70,000 photovoltaic panels. At its peak, the site will generate 280 full-time jobs and $20-million in labour income. (Tilley Solar Alberta/Supplied via The Globe And Mail)

Concurrently, Alberta is overhauling its electricity market in a way that, according to independent analysis, imposes structural disadvantages on variable generators like wind and solar. The province is also challenging the constitutionality of the federal Clean Electricity Regulations, which provide a national roadmap for grid decarbonization by 2035. These combined factors have created a sense of long-term uncertainty that is difficult to reconcile with capital planning and infrastructure development timelines.

Alberta has also proposed ending the zero-congestion requirement on transmission lines, which means renewable generators could be restricted from sending electricity to the grid, even when producing at full capacity. This has major implications for the economic viability of clean energy projects that depend on grid access to monetize their output.

Peer Jurisdictions Show a Different Story

What is happening in Alberta is not being echoed in other deregulated electricity markets.

In Texas, for example, which operates the largest deregulated grid in North America, investment in renewables continues to surge. Developers there benefit from a clear policy trajectory and consistent signals from regulators. The state’s interconnection queue has grown steadily from 2021 through 2025, reflecting growing demand for clean power and confidence in the permitting process.

South Australia offers another powerful contrast.

Despite its grid being roughly one-fifth the size of Alberta’s, South Australia now sources 71% of its electricity from wind and solar. Alberta, by comparison, stands at just 18%. Yet it is Alberta—not South Australia—that has adopted visual impact restrictions and land-use rules that effectively prevent wind deployment in large swaths of its landscape.

These jurisdictions have leaned into the energy transition by modernizing regulations, building new transmission capacity, and supporting energy storage. Alberta’s policies, in contrast, seem to be designed more to limit the scope of renewable development than to encourage it. This divergence is beginning to show in the data: while Texas and South Australia continue to scale up both solar and wind, Alberta is becoming a less competitive destination for clean energy investment.

Solar Persists, Wind Stalls

Despite the turbulence, Alberta’s solar sector is showing signs of resilience. As of May 2025, ten large-scale solar projects are under construction, representing approximately 1,900 megawatts of new capacity. An additional fifteen projects, totaling around 1,200 megawatts, have received regulatory approvals and are awaiting construction. If all proceed as currently scheduled, Alberta could double its installed solar capacity by 2028.

This momentum is partly driven by declining global solar equipment costs and partly by the fact that solar projects are less affected by Alberta’s new land-use and visual landscape rules.

Wind energy, however, tells a different story. Out of 22 wind or hybrid wind-plus-storage projects currently in the AESO connection queue, only one is under construction. Two others have permits but remain dormant. The remainder appear to be in limbo, as developers assess the risks introduced by post-moratorium rules. Setback regulations, unpredictable transmission access, and policy volatility are proving too much for many wind investors.

This sharp divergence between solar and wind runs counter to global trends, where wind power continues to grow at an average annual rate of 10%. While solar’s growth is welcome, Alberta risks overreliance on a single technology stream, weakening the resilience of its electricity system and sidelining the province’s considerable wind resources.

An Avoidable Reversal

Alberta’s declining investment climate isn’t the result of poor fundamentals. The province still has world-class solar and wind resources, existing transmission infrastructure, and a workforce capable of building and maintaining complex projects. The problem is perception. Sudden regulatory shifts, moratoriums, ambiguous restrictions, and politically charged court challenges create a sense that Alberta is not a reliable partner for long-term energy investment. It doesn’t have to be this way.

Jurisdictions that are attracting capital are doing so by offering certainty, not subsidies. Alberta has the tools to return to leadership. The government could restore confidence by clearly defining a long-term electricity strategy that embraces low-cost renewables and energy resilience. It could designate development corridors for renewables where environmental and land-use conflicts are pre-resolved. It could streamline permitting in those zones, fast-track approvals, and update transmission policy to integrate energy storage and distributed generation.

Alberta doesn’t need to invent a new model—it simply needs to adopt one that’s already working in places like California, Virginia, and Colorado, where similar tools are being used to align energy, climate, and economic development goals.

Our Perspective

Alberta is no longer competing with itself from 2020—it’s competing with jurisdictions that are thinking ten years ahead. The global energy transition is moving quickly, and while Alberta once led, it now risks becoming an outlier. The capital, technology, and talent needed to build the future are still available. But without clear signals and consistent policy, they’ll go where they’re welcomed.

Alberta has not run out of resources—but it is running out of time to rebuild the confidence it once enjoyed.

Comments