About this Report

This Alberta Solar Market Insight is a solar industry review and analysis of the Alberta industry developed by pvbuzz media.

PVBUZZ Media conducted good-old fashion in-depth research and combined these efforts with existing data to deliver a report that includes a complete history of solar adoption in the province of Alberta, Canada.

This report is most useful for construction, finance, engineering and other venture-type companies weighing the decision to invest or make a move to Alberta. The report identifies and analyzes trends in residential and commercial solar growth and installation.

The report and analysis are important in forecasting future industry growth and capacity potential in the province.

All data analyzed in this report was collected from information provided by the Alberta Electric System Operator (AESO). The AESO is responsible for the safe and reliable operation of the Alberta Interconnected Electric System (AIES).

Table of Contents

I. BACKGROUND INTRODUCTION

A. ALBERTA ON THE SPOTLIGHT:

B. FOSSIL FUEL EMISSIONS IN ALBERTA:

C. SOLAR POTENTIAL IN ALBERTA:

II. UNDERSTANDING ALBERTA’S ELECTRICAL SECTOR

A. ELECTRICITY MARKET:

B. COST OF ELECTRICITY:

III. SOLAR PHOTOVOLTAIC (PV) ENERGY

A. MARKET STATUS:

B. COST OF SOLAR ENERGY:

IV. GROWTH OF SOLAR PHOTOVOLTAIC (PV) ENERGY

A. BACKGROUND OF SOLAR PHOTOVOLTAIC (PV) ENERGY IN CANADA:

B. SOLAR PHOTOVOLTAIC (PV) ENERGY (MICRO-GENERATION):

C. SOLAR PHOTOVOLTAIC (PV) ENERGY FARMS:

D. INSTALLED PV MICRO-GENERATION + UTILITY-SCALE PV FARMS UNDER DEVELOPMENT:

V. CONCLUSION

A. ALBERTA RESIDENTIAL AND COMMERCIAL SOLAR PROGRAM:

B. SOLAR BUSINESS POTENTIAL:

C. ALBERTA’S SOLAR FUTURE:

I. Background Introduction

A. ALBERTA ON THE SPOTLIGHT:

The solar industry in Canada is primed to participate in the Government of Alberta’s newly launched Residential and Commercial Solar Program – a 36 million dollar program supporting the installation of solar electricity generation on residential, multi-residential and small commercial roofs across the province with the goal of achieving 10,000 new solar roofs.

This program will complement other supportive policy targeting households, businesses, farms, indigenous communities, and municipalities to make investments in becoming more energy efficient.

Under this program, solar installations on rooftops are expected to increase from 1,800 to 10,000 systems, which will create about 900 jobs and reduce greenhouse gas emissions by a half million tons (or the same as taking 100,000 cars off the road).

The program is funded through the province’s carbon tax revenue.

B. FOSSIL FUEL EMISSIONS IN ALBERTA:

Alberta is almost single-handedly responsible for nearly all of Canada’s current and near-future growth of greenhouse gas emissions between 2005 and 2020. Dollar for dollar, solar energy projects have the greatest potential to reduce emissions and enhance Alberta’s flagging reputation at the same time.

Alberta burns more coal than the rest of Canada combined, and it has the carbon emissions to prove it. The province is talking about the right things in reducing coal and beefing up solar energy capacity.

C. SOLAR POTENTIAL IN ALBERTA:

Solar is an opportunity for the Alberta government to address its dirty electricity problem and an instant win as far as GHG reductions go. And it’s worth noting that the single biggest greenhouse gas reducing project the Alberta government has funded through its carbon levy program was the 300-megawatt Blackspring Ridge wind project.

Alberta is an excellent place to build solar arrays.

According to Statistics Canada, the province, particularly the south, receives more than 2,300 hours of sunlight each year – more than every province but Saskatchewan. To put that in perspective, the cities of Edmonton and Hamburg, in Germany (the world’s largest producer of solar power), both sit at 53 degrees latitude north.

That means if a solar panel were to be installed identically in both cities, the one installed in Edmonton, Alberta would produce 60 percent more electricity, because of more sunlight, but also because the region is slightly cooler.

Even factoring in the loss in efficiency when panels are covered with snow during the winter months, Alberta could easily draw far more energy from the sun, per panel, than the leading solar-producing jurisdiction.

II. Understanding Alberta’s Electrical Sector

A. ELECTRICITY MARKET:

Alberta is phasing out all coal-fired electricity generation in the province by 2030. The province has also set a target for 30 percent renewable energy generation by 2030.

The Province is on track to deliver on the promise of reliable, low cost, low carbon, low pollution energy.

In Alberta’s deregulated electricity market, the price of electricity is set by the market, based on supply and demand in each hour. Electricity was deregulated in 1996, and in 2001 Albertan individuals, families and small businesses were given a choice as to where and how to purchase their electricity.

They could continue to purchase electricity from a retailer regulated by the Alberta Utilities Commission (the Regulated Rate Option, or RRO), or enter into a contract with a competitive retailer. Today, the price for electricity under the RRO varies from month to month and is based on the market price for power.

Contracts with competitive retailers can take many forms, with prices locked in for a specific term or float based on the market price. The majority of Albertans have chosen to stay on the RRO.

B. COST OF ELECTRICITY:

A utility bill in Alberta is composed of various charges including cost of energy, the cost of delivering that energy, local access fees, and retailer administrative fees. According to data from the calculated average regulated option offered by Enmax Power Corporation in Calgary from 2011 to 2016, the cost of electricity is 8.46 c/kWh.

April 2016 data from Enmax also includes a variable tariff for residential customers at 2.84 c/kWh for delivery. There is also an 11.1 percent RRO and distribution tariff charges (Calgary local access fee) of 1.24 c/kWh to bring it to a total cost of consumption at 12.54 c/kWh.

III. Solar Photovoltaic (PV) energy

A. MARKET STATUS:

While solar energy is not the first thing that comes to mind when one thinks of Alberta, things are changing in the province. Solar uptake has doubled in the province since 2015, bolstered by initiatives like the Alberta Municipal Solar Program and the On-Farm Solar PV Program.

Last December 21, 2016, the Government of Alberta amended the Micro-generation Regulation to provide more flexible rules for Albertans generating their own electricity. This increased the size limit of a micro-generation system from one megawatt to five megawatts and allows a solar array to serve adjacent sites.

Depending on how much energy a homeowner sends back to the grid, they will be credited in accordance with micro-generation regulation. Energy retailers must buy back exported power at a rate equivalent to the customer’s retail rate.

Alberta’s newly created $36-million solar rebate program will help cut solar installation costs. Under this program, rebates of up to 30 percent will be offered to homeowners.

This rebate is expected to be 75 cents per watt, with a system cap that has not been announced at the time of this report. Over the next five years, this Residential and Commercial Solar Program will build on previous existing solar incentive programs.

B. COST OF SOLAR ENERGY:

The average price per watt of solar energy in Alberta is $2.50. In order to create enough solar energy to power a typical home, a homeowner would need a solar system between 5.5 and 6 kilowatts in size.

The Solar Energy Society of Alberta estimates that a solar photovoltaic system can be installed to accommodate an average household’s electricity demand — estimated at 5.5-kilowatt hours (kWh) per year — for about $13,750 and a 6-kilowatt system would be $15,000. That’s where the new rebate program will come in, significantly reducing the payback period, cutting the current 15 to 20-year payback timeframe by about 30 percent.

With the government rebate of 75 cents per watt, or 30 percent, the prices would decrease to $9,625 and $10,500, respectively, not including installation costs. The initial cost can be a deterrent for residential and business owners.

IV. Growth of solar photovoltaic (PV) energy

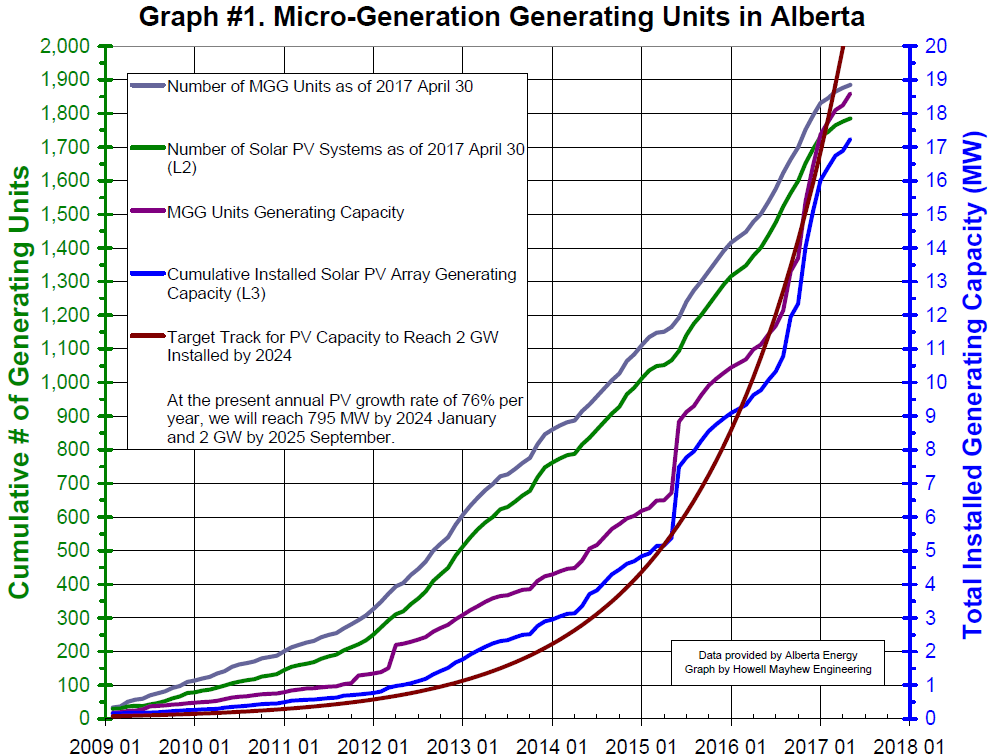

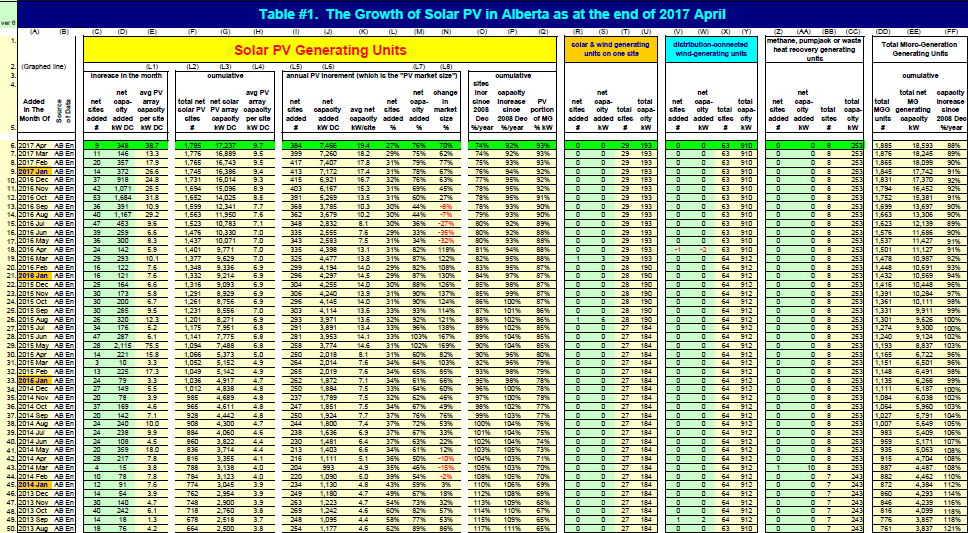

The installation of grid-connected solar PV systems is growing rapidly in Alberta. This document highlights this growth since 2008 and its status as of 2017 April 30.

A. BACKGROUND OF SOLAR PHOTOVOLTAIC (PV) ENERGY IN CANADA:

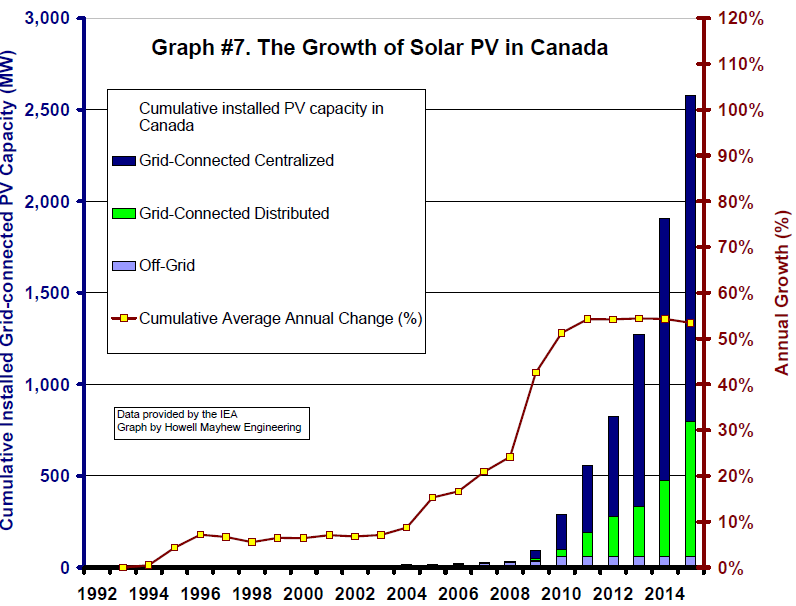

In comparison to Alberta, as of the end of 2015, data provided by the International Energy Agency, Photovoltaic Power Systems Program indicates that Canada had 2580 MW of grid-connected solar PV installed and Alberta had 9 MW. As of last month, Alberta has 1785 grid-connected PV systems with a total of 17.2 MW. Canada currently has about 3300 MW capacity installed (the statistics for 2016 will be published in September).

The 2015 data shows that Canada has 286 times as much PV as Alberta. Ontario has over 99% of Canada’s PV capacity.

Alberta is second at 0.4%. In comparison to Canada, there is now 227 GW of solar PV installed around the world at the end of 2015. Canada has 1.1% of the world’s capacity. We include a graph of the growth of PV in Canada and around the world since 1992.

B. SOLAR PHOTOVOLTAIC (PV) ENERGY (MICRO-GENERATION):

According to data provided by Alberta Energy, Alberta’s solar patch has 1785 operational PV generating units and 17.2 MW DC of PV capacity now.

The growth over the last year has been 384 or 27% in new systems and 7,466 MW or 76% in new DC generating capacity. The average cumulative growth since 2008 is 74% per year in systems and 92% per year in capacity.

Much is happening behind all these numbers of course. We will expect to now see a significant increase in the Alberta government’s new incentives in the Residential and Commercial Solar Program, along with the incentives in the Alberta Indigenous Solar Program, the Alberta Municipal Solar Program, and the Growing Forward program.

The average PV system capacity continues to increase. Last month the average capacity was 38.7 kW per system, compared to 5.9 kW a year ago. The data in Table #1 and Graphs #1 to #4 are for micro-generation solar PV systems that are

in operation.

18 such systems have been decommissioned to date and have been subtracted from the list. The data does not include PV systems that are still in the application process.

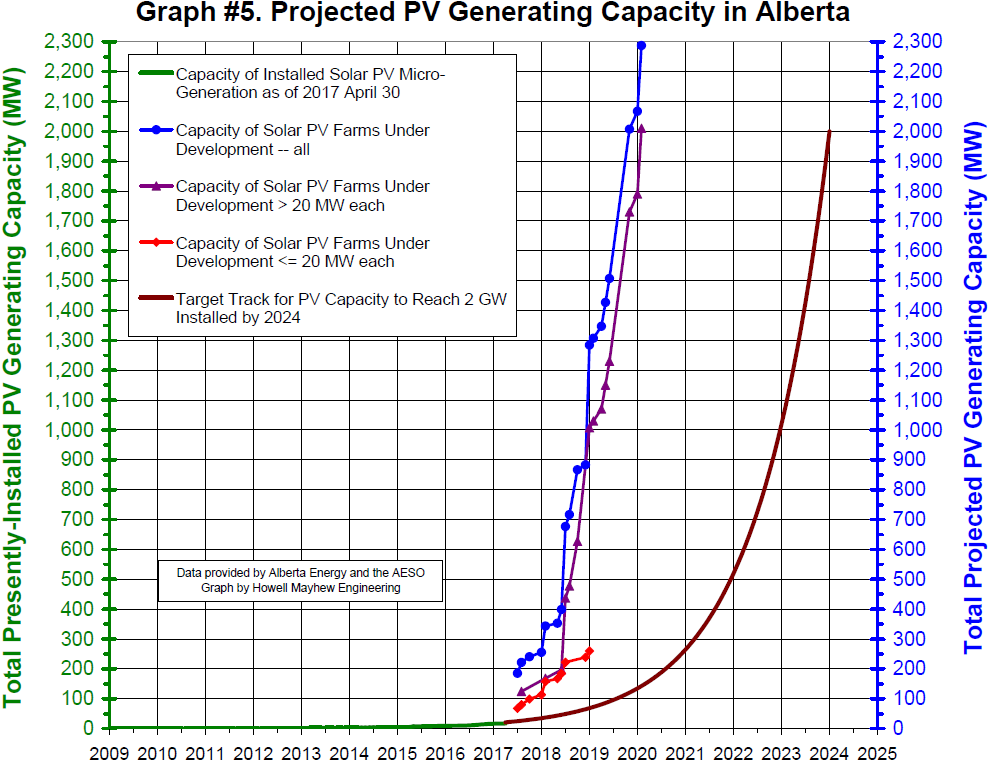

C. SOLAR PHOTOVOLTAIC (PV) ENERGY FARMS:

Table 2 lists solar PV projects from the AESO’s connection project list. 45 PV projects are listed as being under development at this time totaling 2270 MW. This is an increase of 5 in quantity and an increase of 51% in capacity from the 40 farms and 1508 MW listed in the March project list. We don’t know if this is the rated DC array capacity or rated AC inverter capacity. As a note, PV should always be listed as the rated DC array capacity.

D. INSTALLED PV MICRO-GENERATION + UTILITY-SCALE PV FARMS UNDER DEVELOPMENT:

The following graphs and tables of data describe the growth of grid-connected solar PV systems in Alberta.

CLICK ON THE IMAGE TO ENLARGE

Graph #1 shows the capacity of micro-generation generating units of all technologies. Data provided by Alberta Energy

Graph by Howell-Mayhew Engineering

CLICK ON THE IMAGE TO ENLARGE

Graph #2 shows the capacity of only the solar PV micro-generation generating units, plus an arbitrary curve leading to a 2 GW capacity for solar PV by 2024.

Data provided by Alberta Energy

Graph by Howell-Mayhew Engineering

CLICK ON THE IMAGE TO ENLARGE

Graph #3 shows the annual solar PV market, which is the capacity that is installed every year.

Data provided by Alberta Energy

Graph by Howell-Mayhew Engineering

CLICK ON THE IMAGE TO ENLARGE

Graph #4 shows how the solar PV market is changing.

Data provided by Alberta Energy

Graph by Howell-Mayhew Engineering

CLICK ON THE IMAGE TO ENLARGE

Graph #5 shows both the PV micro-generation generating units and the utility-scale solar PV farms under development.

Data provided by Alberta Energy

Graph by Howell-Mayhew Engineering

Graph #6 shows the change in average PV system capacity.

Data provided by Alberta Energy

Graph by Howell-Mayhew Engineering

CLICK ON THE IMAGE TO ENLARGE

Graph #7 shows the growth of solar PV in Canada since 1992.

Data provided by Alberta Energy

Graph by Howell-Mayhew Engineering

CLICK ON THE IMAGE TO ENLARGE

Graph #8 shows the growth of solar PV worldwide since 1992.

Data provided by Alberta Energy

Graph by Howell-Mayhew Engineering

CLICK ON THE IMAGE TO ENLARGE

Table #1 shows the annual data underlying these graphs.

Data provided by Alberta Energy

Graph byHowell-Mayheww Engineering

CLICK ON THE IMAGE TO ENLARGE

Table #2 shows the PV projects under development as listed on the AESO’s March connection project list (https://www.aeso.ca/grid/connecting-to-the-grid).

Data provided by Alberta Energy

Graph by Howell-Mayhew Engineering

CLICK ON THE IMAGE TO ENLARGE

V. Conclusion

A. ALBERTA RESIDENTIAL AND COMMERCIAL SOLAR PROGRAM:

The Residential and Commercial Solar Program offers rebates to homeowners, businesses and non-profits that install solar photovoltaic (PV) systems. Bolstered by other initiatives like the Alberta Municipal Solar Program and the On-Farm Solar PV Program, solar uptake has doubled in the province since 2015.

Information on the “Efficiency Alberta” states that the program will launch in June 2017.

As part of eligibility requirements, the program is available for customers with electricity service and properties located in Alberta that meet the following requirements:

1. Interconnection approval from the Wire Service Provider (WSP) signed on or after April 15, 2017

2. The solar photovoltaic (PV) system must be grid-connected in accordance with Alberta’s Micro-generation Regulation (AR27/2008)

3. The system must not be eligible for the Alberta Municipal Solar Program (AMSP), the Alberta Indigenous Solar Program, Growing Forward On-Farm Solar Photovoltaics Program, or any other provincial solar incentive program that may follow

4. Must not have received an incentive for a solar PV system on the same parcel/property (based on site ID) under this program or another provincial solar incentive program

5. Combined incentives from government programs must not exceed 100% of the eligible system costs.

6. Must own the property or have long-term rights to the property with sufficient solar exposure.

7. System is designed and installed by a qualified installer (not self-installed) and system components meet the Canadian Standards Association (CSA) requirements for electrical safety or equivalent certification to applicable Canadian standards.

7. Complete Terms and Conditions will be available at program launch.

| # | Residential ($/watt) | Commercial or Non-Profit ($/watt) |

|---|---|---|

| 0 to 15 kW | $0.75/watt | # |

| 0 to 5 MW | # | $0.75/watt |

| Maximum payable incentive | The lesser of $10,000 or 30% of eligible system costs | The lesser of $500,000 or 25% of eligible system costs |

B. SOLAR BUSINESS POTENTIAL:

The total population of Alberta is 4.28 million. The provinces 2011 statistics data indicates there are over 883,265 single-detached houses in the province. This presents a tremendous opportunity for solar companies to pitch their solar energy services.

There are about 315,000 residential rooftops with the potential for solar energy installations. The market size potential through 2030 is about 1,890 megawatts (DC).

There are over 3,000 commercial or industrial buildings with potential for solar installations with market size potential through 2030 close to 302 megawatts (DC).

There are currently over 18,500 farms in Alberta with a solar capacity potential of about 262 megawatts (DC).

The grid-connected peak demand is approximately 11,229 megawatts. Total installed solar capacity in the province till date is 16 megawatts.

The Solar Energy Society of Alberta lists over 100 solar providers that currently operate in the Alberta Solar market.

The Solar Energy Society of Alberta lists over 60 equipment suppliers that currently operate in the Alberta Solar market.

C. ALBERTA’S SOLAR FUTURE:

Alberta’s solar industry has grown one-hundred percent each year for the past three years. The industry is on track to experience exponential growth in the residential, and commercial sectors this second half of 2017.

Alberta’s current micro-generation regulation requires low cost or free interconnection for small projects, but it hasn’t been enough for the industry to take off. That’s where a renewable energy framework like this newly announced rebate program can help.

While Ontario solar companies are watching, it’s existing players who may be best positioned to kickstart Alberta’s nascent solar industry.

A major hindrance to the industry’s growth may be the project’s queue. Many fear that there are way too many agricultural, commercial and community projects in the Alberta Electric System Operator (AESO) connection queue; awaiting access to the grid.

Also, Alberta has a twentieth-century electricity system that was set up not to make sense for homeowners.

Distributed resources in Alberta, which are those smaller power sources like residential solar systems, are valued the same as all other energy sources. So households aren’t given value for the energy they produce.

In general, though, Alberta’s solar industry lags behind even the rest of Canada, which was itself a late adopter. Percentage-wise, Alberta’s solar industry has been growing by double digits every year for the past five years, even without a major FIT-in-Tariff program like Ontario.

To date, Alberta has installed approximately 10 megawatts of solar across the entire province. By contrast, Ontario, the leading Canadian province, will reach 2,500 megawatts by year’s end.

But Alberta may benefit from the fact that many of the barriers that the solar industry faced in its early years have been significantly reduced.

Take costs: since 2009, the price of installing a solar array has dropped by approximately 70 percent. A few years ago, an installed solar panel could cost upwards of $1,000 each; today, the same panels would run about $250 each.

Even when you factor in the current overproduction in Alberta’s electricity industry, which has driven prices abnormally low, solar is still competitive, if not cheaper, option for many projects.

That trend is expected to continue, particularly since the province phases out its coal-fired power plants over the next decade and envisions 30 percent of the province’s electricity coming from renewable sources by 2030.

Meanwhile, a growing public awareness of the environmental impact of the oil sands means that consumers are more willing than ever to seek out renewable energy sources whenever they can.

The final major piece of the puzzle, however, is support from the government.

From Germany to Ontario, solar industries have been able to get the jump-start they needed only when their local governments introduced incentive programs.

#Quicktip for solar pros:

Targeting residential and suburban regions south of the city of Edmonton will be a good fit for solar lead generation.

—-

Thanks for purchasing the article and for being part of the solar revolution. Please let us know if you have any specific questions or have specific needs requiring specific services.

We appreciate your support and look forward to doing business with you in the near future.

NOTE: All figures displayed in this report are developed by Howell-Mayhew Engineering and should be credited accordingly.

Comments