- China controls at least 75% of every key stage in producing and processing solar panels.

- Due to recent and unforeseen manufacturing halts in the country, polysilicon prices rose to a 10-year high.

- One of the greatest challenges for diversifying solar supply chains is the cost competitiveness of existing panel manufacturing options.

- Two potential solutions include building manufacturing facilities around low-carbon industrial clusters and recycling panels.

To meet global climate goals, solar panels’ production capacity and inputs must double by 2030.

One of the key takeaways from the International Energy Association’s recent special report, is that China’s dominance over the supply chain presents a great threat to the world’s ability to meet its solar panel production goals. But the contry’s renewable energy materials and infrastructure dominance don’t stop with solar. The country is also the leading global producer and processor of the rare earth minerals needed for the magnets that power wind turbine generators. In 2021 alone, China built more offshore wind turbines than all other countries combined over the past five years.

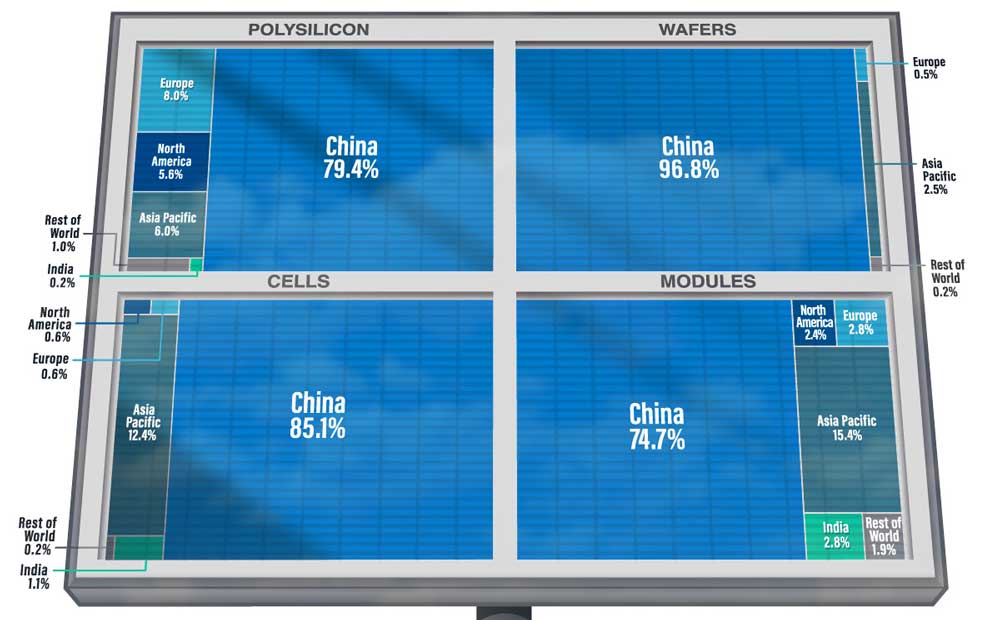

Currently, China controls at least 75% of every key stage of the manufacturing and processing of solar photovoltaic panels. Its share in solar panel manufacturing has been steadily increasing over the past 12 years, from polysilicon production to soldering finished solar cells and modules onto panels.

To put this into perspective, tn 2010, China’s share in the solar supply chain was 55%, and now it’s closer to 84%.

One of the points emphasized in the IEA’s special report is the importance of distributing global solar panel manufacturing capacity. Due to recent and unforeseen manufacturing halts in China, the price of polysilicon rose to a 10-year high, which showcased the world’s ongoing dependence on China for supplying key materials for renewables.

To meet international energy and climate goals, the global deployment of solar PV needs to grow at an unprecedented scale. For this to happen, a significant manufacturing capacity expansion must also occur, which has been met with concern regarding the world’s ability to swiftly develop resilient supply chains.

This visualization by Visual Capitalist shows the shares held by different countries and regions of the key stages of solar panel manufacturing, using data from the International Energy Agency (IEA).

To get an idea of the sheer magnitude of growth required, the annual solar PV capacity additions would need to more than quadruple to 630 gigawatts by 2030, in order to stay on track with the IEA’s Roadmap to Net Zero Emissions by 2050. In addition, the global production capacity for polysilicon, ingots, wafers, cells and modules would need to double by 2030.

One of the greatest challenges for diversifying solar supply chains is the cost competitiveness of existing solar PV manufacturing options. China remains the most affordable place to manufacture all components necessary for the solar PV supply chain, with costs 20% lower than India, 20% lower than the U.S. and 35% lower than Europe.

The differences in cost can be explained by variations in energy, labour, investment, and overhead costs.

Two potential solutions include building solar PV manufacturing facilities around low-carbon industrial clusters and recycling solar PV panels. Building solar PV manufacturing around low-carbon clusters can unlock benefits such as manufacturers using their products to generate electricity, reducing both their electricity bills and carbon emissions.

Also, building manufacturing facilities near other emerging industrial clusters, such as renewable-based hydrogen, would help utilize vertical integration and benefit from cost-competitive renewable energy sources, thereby increasing competitiveness.

Recycling solar PV panels also offer environmental and economic benefits while enhancing the long-term security of the solar supply chain.

If systems were in place to collect solar panels at the end of their lifetime, recycling them could help meet over 20% of the global solar PV industry’s demand for aluminum, copper, glass, and silicon and almost 70% for silver. However, existing recycling panels’ existing processes struggle to generate enough revenue to offset the cost of the recycling processes.

While there has been a significant focus worldwide on reducing emissions, countries also need to ensure their path towards more sustainable energy systems has a strong foundation. In terms of solar, this means scaling up solar PV supply chains in a resilient, affordable, and sustainable way around the world.

For this to happen, a larger investment in research and development is needed to ensure we make existing processes more efficient and facilitate the emergence of innovative solutions to current roadblocks.

Comments