Things are heating up in Florida after the State Supreme Court ruled in favor of an amendment that would allow rooftop solar PPAs for projects 2MW and under.

Pro-solar advocacy group Floridians for Solar Choice (not to be confused with the utility-funded, anti-solar group, Consumers for Smart Solar now has until February 1 to secure 300,000 additional signatures to be included on the 2016 ballot (Are you in Florida? If so, sign here).

If the ballot initiative passes, North Carolina, Oklahoma, and Kentucky would be the only states in the U.S. that still explicitly prohibit third-party rooftop PPAs. You snooze, you lose.

2015 has been an especially important year for the authorization of third-party financing in the Southeast after Georgia and South Carolina both added third party ownership to their menus. But, as we have said time and time again, just because it’s legal, it doesn’t mean it will pencil.

The latter depends on an optimal recipe of high irradiance and high electricity prices, as well as a mix of favorable local, state, and federal policies. The absence of one of these ingredients will weaken an investor’s appetite for a given deal.

For example, while Georgia and South Carolina have legalized third-party solar, property taxes continue to stifle deals. Moreover, low electricity prices mean that projects are tight unless a developer can build at extremely low costs. These all tamper with the flavor of a given deal.

On top of this all is the looming step-down of the 30% solar investment federal tax credit.

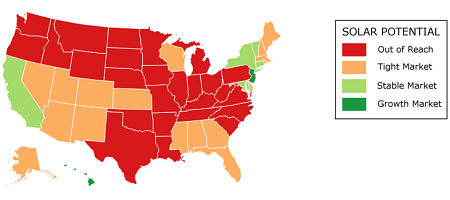

Unfortunately, that means that much of what has been cooking in the Southeast will be moved to the back burner until a 30% extension or commence construction is achieved, regardless of supportive solar policy and other local ingredients. Even North Carolina, the Southeast’s solar darling with 1.1GW of solar capacity, will suffer without a federal extension. Take a look at the map below, and you will see that many tight Southeastern markets become out of reach with a 10% ITC and an 8% cost of capital.

At Sol Systems, we believe that a multi-year extension of the investment tax credit is needed to allow enough time for costs to fall further. If you’re interested in seeing how ITC scenarios will affect solar in your state, visit Raceto2017.com and get involved. You can also tune into this SEIA webinar with tips on how to reach out to your federal representatives and show them that solar works in their districts.

Sol Systems is a solar energy finance and investment firm. The company has facilitated financing for over 375MW of solar projects on behalf of Fortune 100 corporations, insurance companies, utilities, banks, family offices, and individuals. Sol Systems provides secure, sustainable investment opportunities to investor clients, and sophisticated project financing solutions to developers.

The company’s tailored financial services range from tax structured investments and project acquisition, to debt financing and SREC portfolio management. Inc. Magazine named Sol Systems on its annual Inc. 500 list of the nation’s fastest-growing private companies for a second consecutive year, ranking it No. 6 in the nation’s top solar companies in 2014.

This article has been published here by the PVBUZZ team from the original article written by Sara Rafalson for publication on SolSystems.

Comments