Tesla, Inc., formerly called Tesla Motors, is a U.S. based automotive and energy company in Palo Alto, California. Tesla was co-founded by engineers Martin Eberhard and Marc Tarpenning, under the name Tesla Motors. The company’s name is a tribute to engineer Nikola Tesla.

Tesla Motors was joined by Elon Musk, J.B. Straubel, and Ian Wright, all of whom are retroactively allowed to call themselves co-founders of the company.

Elon Musk is a South African-born American entrepreneur and businessman who previously founded X.com in 1999 (which later became PayPal), he also founded SpaceX in 2002. Musk is the current chief executive officer of Tesla.

Today, Tesla specializes in electric car manufacturing and, solar panel manufacturing through its SolarCity subsidiary. The automaker says it is accelerating the world’s transition to sustainable energy with electric cars, solar panels and integrated renewable energy solutions for homes and businesses.

Tesla is a publicly-traded company under the symbol TSLA with the Nasdaq Stock Market.

Let’s get right to it.

We all know TSLA is the most shorted stock—that’s just business. But what I don’t understand is why so many people like to “hate” the company, spread fake news about Elon Musk or that Tesla is going bankrupt.

Most news networks (e.g. CNN, MSNBC, FOXNews, etc.) like to bash Tesla when the company releases quarterly earnings. Take this title for example from CNBC “Tesla has worst day of 2019 after earnings and loss of CTO“.

This news article only said three things:

That Tesla reported a wider-than-expected loss and weaker-than-expected revenue, that during the earnings call, CEO Elon Musk said co-founder and longtime chief technology officer (CTO), J.B. Straubel is leaving, and that the stock fell 13.6 percent, the most since September 2018.

This sounds like bad news for Tesla, and for those with TSLA stock.

But these news networks don’t give you the full picture, nor do they explain the story—which starts looking a lot normal and like a “nothing to see here” type situation when you get all the facts. Plus, we have to understand that traditional news media thrive, and get more ratings when they report negative stories.

Interested in the full picture? and why I think Tesla is not going broke? Let me explain—and in case you are wondering … I don’t own any TSLA stock, so this is as real as it gets.

The News Story

We (pvbuzz.com) published a news brief that summarized Tesla’s second-quarter earnings report. The news brief reported that Tesla lost USD $408 million in that quarter despite delivering a record number of vehicles. To be fair, this was a news brief that didn’t paint the entire picture.

Former Jeffrey Straubel, chief technical officer and co-founder of Tesla Motors Inc., center, speaks as billionaire Elon Musk, chief executive officer of Tesla Motors Inc., left, and Yoshihiko Yamada, consultant at Panasonic Corp., look on during a press event at Tesla’s new Gigafactory in Sparks, Nevada, U.S., on Tuesday, July 26, 2016. (Troy Harvey | Bloomberg)

The news brief added that the company’s co-founder and CTO, J.B. Straubel, is leaving. No. He is not leaving Tesla, he is stepping down from his day-to-day role as an executive and will continue with Tesla as a senior advisor. Straubel himself elected to do this.

J.B. Straubel has been the CTO at Tesla since 2005, with his recent duties including overseeing the company’s energy business, its Supercharger network, and its battery plant in Nevada. His replacement as CTO is Drew Baglino, the vice president of technology.

There are many speculations as to why this drastic and sudden change, but as someone who has dabbled in corporate politics, and as a founder myself, I can understand this move. Since Straubel wasn’t fired—my two cents on the matter would be that Tesla needs someone in that role that can be pressured or properly incentivized to make tough decisions without their sentimental attachment to the company ‘being’ an issue.

Many took this news story to indicate that Tesla is running out of money and maybe going bankrupt. Even the stock market panicked as Tesla stock dropped; after the release of the company’s Q2 earnings results, which fell below Wall Street’s estimates.

Tesla isn’t going broke like most news networks are reporting. In fact, the company has so much cash they could lose another USD $408 million every month (with no production) for the next 3 years, and still not go bankrupt.

The earnings call and a deep dive into the numbers

According to the Q2 earnings call, Tesla reported a GAAP operating loss of USD $167 million and a GAAP net loss of USD $408 million, including a USD $117 million one time cost for restructuring and other expenses.

Now let’s dive deeper into the numbers.

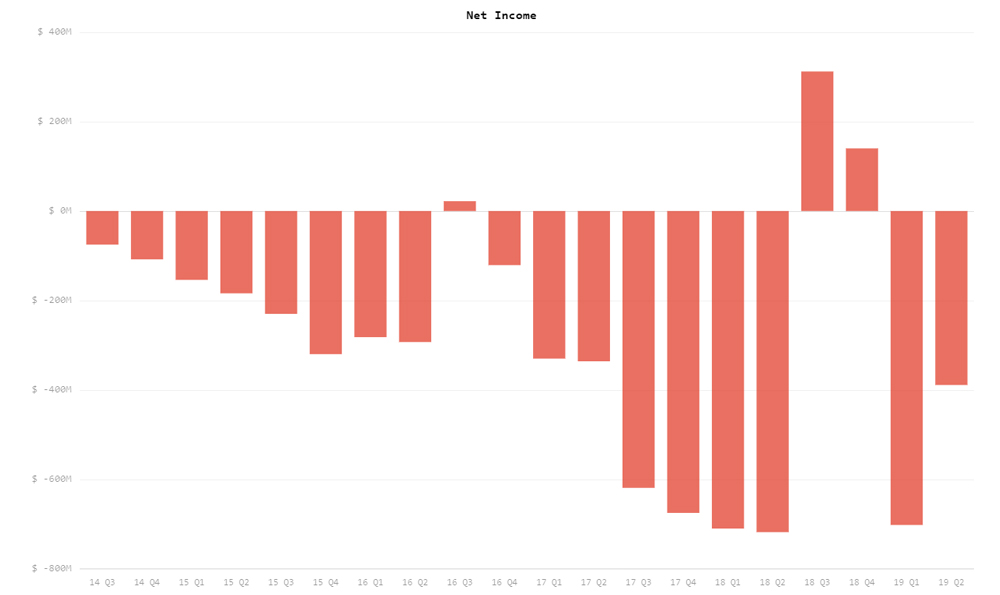

A lot of the coverage focused on the negative, showing a chart like the one below; which is the net income of Tesla.

The chart is all red, and most of it is below the line, basically, it looks horrible. If anyone were to be presented with this chart, they would, of course, conclude that Tesla is burning through cash and is probably hanging by a thin thread.

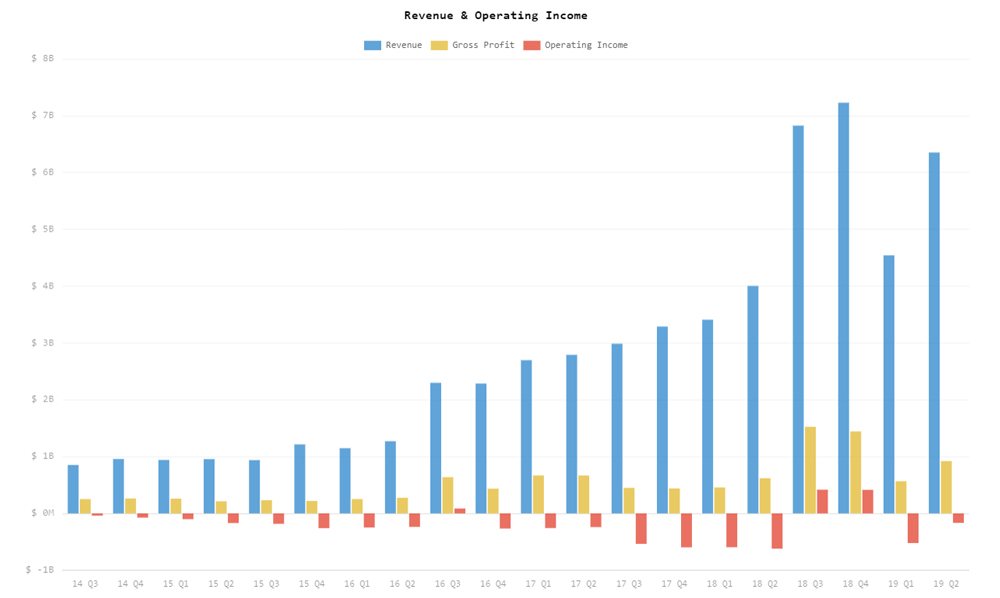

But here’s another chart most people haven’t seen. This next chart is the same as the first but with more information. i.e. the full picture.

In the second chart (above), there is very little red and a lot of blue bars. Blue represents the company’s revenue which is trending upwards. Which generally, is a very good thing for any company.

This chart says that revenue is not only growing, that the growth is crazy, I mean; we are also talking USD $6.8 billion. Also, when we take a look at the orange bars which represent gross profit, we see that Tesla is doing just fine.

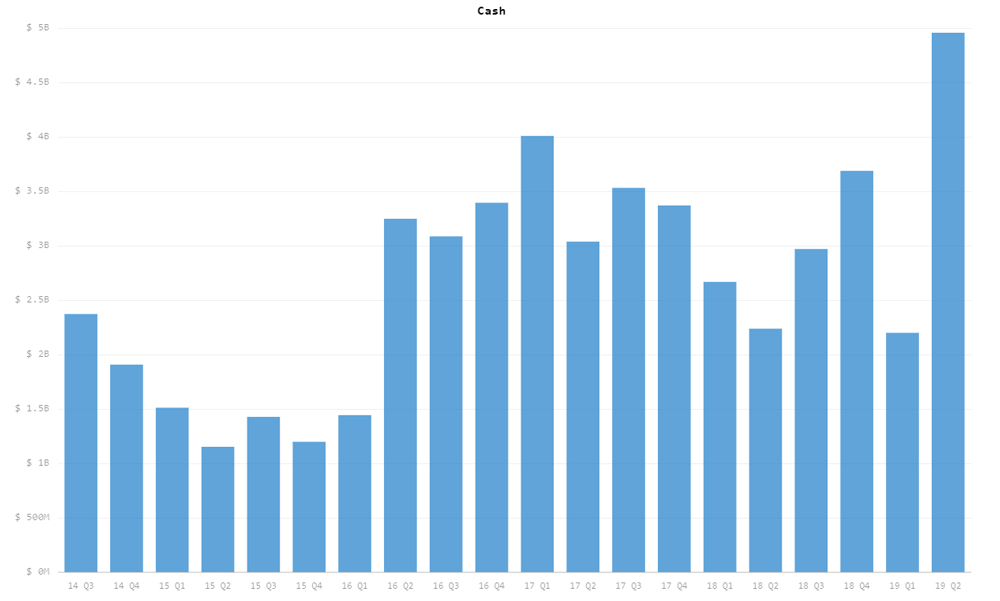

In fact, let’s take this one step further and look at another chart.

This chart represents how much cash the company has right now. They have an estimated USD $4.95 billion in cash. In cash! Looking at the data on this chart, their cash went up this quarter.

How will Tesla fair against the competition?

We have to understand that the Tesla stock is the most shorted stock in U.S. history. Shorting Tesla stock means more investors are betting against the automaker than any other U.S. stock, and they stand a chance of making money when the company fails or goes bankrupt.

Tesla is not going anywhere anytime soon, in fact, traditional car manufacturers like GM, Ford, VW, and Honda are struggling to keep up with innovations at the company, and the changing buying habits brought on by Tesla with more and more customers now demanding a cleaner and fully electric vehicle.

General Motors (GM), the largest U.S. carmaker, has said it will cut production of slow-selling models and cut its North American workforce because of a declining market for traditional gas-powered sedans.

Who would blame traditional car manufacturers for not liking Tesla? or the idea the company represents, and the fast-growing electric vehicle revolution it brings with it. Tesla is putting more pressure on them to quickly ramp up their electric vehicle brands at great cost.

While some of these automakers are open to the change, most are clueless when it comes to the effective use of digital technology, and are unlikely to understand it any time soon.

Some wait till they are forced to do so, or when a scandal hits to make the shift.

It took the worst corporate scandal in automotive history for Volkswagen to make the necessary decision to transform itself to manufacturing more electric vehicles. The company will spend $50 billion over the next five years to develop 50 new electric models and produce 1 million electric cars by 2025. Eh?

Will Tesla survive long term?

Well, let’s look at some of the facts: First, Tesla builds great products. Take the Tesla Model 3 for example. There’s no competitor with regards to safety.

The European New Car Assessment Programme (Euro NCAP) awarded the Tesla Model 3 it’s highest rating of five stars. The Tesla Model 3 earned a 96 percent score for how it protects adults and 86 percent for crash test performance in keeping children safe.

There’s no competitor with regards to security (i.e. how hard it is to steal the car without getting caught). The Tesla Model 3 is the most secure. There’s no competitor with regards to efficiency. The Tesla Model 3 is the most efficient battery-electric vehicle.

There’s no competitor with regards to self-driving, or smarts. The Tesla Model 3 is the smartest car available because its capability grows with time via over-the-air software updates. There’s no competitor with regards to supercharging speed. The Tesla Model 3 is the fastest in its category.

There’s no competitor with regards to range. The Tesla Model 3 goes 310 miles, and the newer Model S and X do 370, on a single charge.

The Tesla Model 3’s interior has attracted a notable amount of criticism. Some lament the lack of physical controls like knobs, buttons, and switches on the vehicle.

My Conclusion

With a car like the Tesla Model 3, and the world moving to electric, especially in key areas like China, Tesla is right where it needs to be. Other car manufacturers are moving, but Tesla is moving much, much faster, so the distance is only going to get bigger.

With growing competition from traditional car manufacturers—that will soon launch their electric vehicle fleets—and the U.S. government awarded electric vehicle rebates expiring soon, the road ahead will be a lot tougher than it is today for Tesla.

So will the company survive?

Yes, because of all the above-mentioned facts. But also because the world is changing and because more people are seeing the impacts of climate change, and want to get involved in the fight.

Most rightly believe that buying an electric vehicle (high probability of being a Tesla) is one way to fight.

Comments