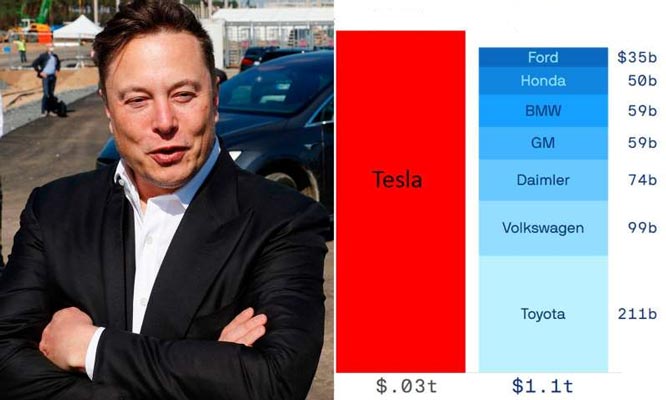

Tesla joined the S&P 500 on Monday at USD $665 a share, making it the most valuable new entrant to the stock index ever. The company’s market cap stands at USD $612 billion, which means the company is worth much more than Ford, Honda, BMW, GM, Daimler, Volkswagen and Toyota combined.

But analysts say the stock is in bubble territory and likely to burst at any minute.

“Tesla stock is too expensive and in a bubble territory compared with its performance,” said Vitali Kalesnik, partner and head of research in Europe at Research Affiliates.

Part of the reason analysts believe the stock is headed for a bubble is the report that Apple is planning to start producing an electric passenger vehicle by 2024. That the vehicles will come with Apple’s own self-driving technology.

The report also talks of new technology that Apple plans to implement that could greatly reduce the cost of battery production and extend vehicle range.

Other analysts say the stock will likely fall (with the rest of the market) amid fears of a new variant of COVID-19, which is now causing new internationals lockdowns, and flight cancellations.

Comments