- Donald Trump is back in the Oval Office with Republican control of Congress, and there's talk of dismantling Biden’s climate policy, the Inflation Reduction Act.

- But with key GOP states reaping the economic benefits of clean energy investments, could Trump risk alienating his base?

- And with Elon Musk in Trump's corner, will the EV sector see a reprieve?

With Donald Trump‘s return to the White House, the future of President Joe Biden’s flagship climate legislation, the Inflation Reduction Act (IRA), is hanging in the balance.

Trump’s victory, coupled with Republican control of the Senate and a likely House majority, has raised serious questions about whether Biden’s sweeping climate initiatives could be scaled back or even dismantled. Trump’s outspoken skepticism toward clean energy incentives has cast a shadow over the electric vehicle (EV) industry and the renewable energy sector, which have been buoyed by the IRA’s provisions.

The IRA’s Impact on Clean Energy and EV Growth

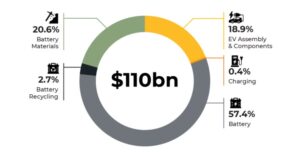

Source: Rho Motion via Benchmark

Since its enactment in August 2022, the IRA has driven over $110 billion in investments into the EV and battery sectors, according to Rho Motion.

The law’s generous tax credits for EV purchases and domestic manufacturing have been pivotal in accelerating America’s transition to clean energy. Notably, the pipeline for gigafactory capacity has seen a dramatic increase—from 360 gigawatt-hours at the start of Biden’s term to 1,310 gigawatt-hours planned by 2030, as reported by Benchmark’s Gigafactory Assessment.

However, Trump has consistently criticized the IRA, particularly the tax incentives aimed at boosting EV adoption, arguing that they unfairly distort market dynamics. His campaign promises included rolling back key provisions, especially Section 30D, which provides substantial tax credits to consumers buying electric vehicles.

Potential Economic Fallout in Republican States

Ironically, the states that have benefited most from the IRA’s investments are largely Republican strongholds. Data indicates that up to 92% of IRA projects are located in red states.

Electrical lines running through a neighborhood on Feb. 19, 2021 in Austin, Texas. Amid days of nationwide frigid winter storms in which 58 people died, more than 4 million Texans were without power for much of that week. (Joe Raedle/Getty Images)

Texas, for example, is poised to lead the nation with the highest gigafactory capacity, translating into $81.5 billion in investments and the creation of thousands of jobs. The prospect of repealing or weakening the IRA could put these economic gains at risk, potentially triggering backlash from within Trump’s own party.

Even with control of both houses, Trump may face internal resistance if he attempts to dismantle a law that has spurred significant job creation and investment in Republican districts. This could force him to focus on altering specific implementation aspects, such as tweaking Foreign Entity of Concern (FEOC) rules that impact supply chains, rather than pursuing a full repeal.

The Musk Factor: A Potential Shift in Strategy?

A significant wildcard in Trump’s approach to the IRA is Elon Musk, the high-profile CEO of Tesla and one of the world’s most influential entrepreneurs.

Known for his innovations in EVs, solar roofs, and energy storage systems, Musk has not only been a major force in the clean energy sector but also a surprising political ally to Trump. During the campaign, Musk publicly endorsed Trump, using his substantial social media influence to rally support and even fundraising on Trump’s behalf.

With Musk’s appointment as lead the newly created Department of Government Efficiency, Trump has made it clear that Musk will play an influential role in shaping policies during his second term. Maybe this could complicate plans to dismantle parts of the IRA, especially considering Tesla’s deep involvement in the EV market and its broader renewable energy ventures, such as solar installations and energy storage.

Tesla CEO Elon Musk, shown at an electric vehicle factory, called ESG ratings ‘a scam’ after an index dropped Tesla. (Maja Hitij/Getty Images)

Musk’s backing could steer Trump towards a more moderate stance on clean energy, particularly on EV-related incentives that benefit Tesla.

While Trump’s alignment with fossil fuels has been a central tenet of his platform, Musk’s influence might prompt a more nuanced approach. It’s possible that Trump could selectively target aspects of the IRA that he deems too restrictive while leaving incentives that bolster domestic EV production and battery supply chains intact. This would align with both Musk’s business interests and Trump’s agenda of bringing manufacturing jobs back to America.

A Balancing Act for Trump’s Climate Strategy

In the end, Trump’s second term could hinge on balancing the demands of his traditional fossil fuel supporters with the economic and political realities of a green energy transition that has already brought significant benefits to key Republican states. As the dynamic between Trump and Musk unfolds, it remains to be seen whether this alliance could shape a more pragmatic approach to the IRA, preserving elements that drive job creation while scaling back regulations seen as overly burdensome.

For now, uncertainty prevails.

But with Musk’s influence in the mix, the prospect of Trump fully dismantling Biden’s climate legacy might not be as straightforward as it once seemed. As the U.S. continues to navigate the transition to a clean energy future, the next few months will reveal whether Trump’s policies align with Musk’s vision—or diverge in favor of a return to fossil fuel dominance.

Comments