Enphase Energy, the world’s largest manufacturer of microinverters, announced its Q4 (2019) financial results and markets responded positively to the news.

It was the company’s first quarterly period with at least $200 million in revenue.

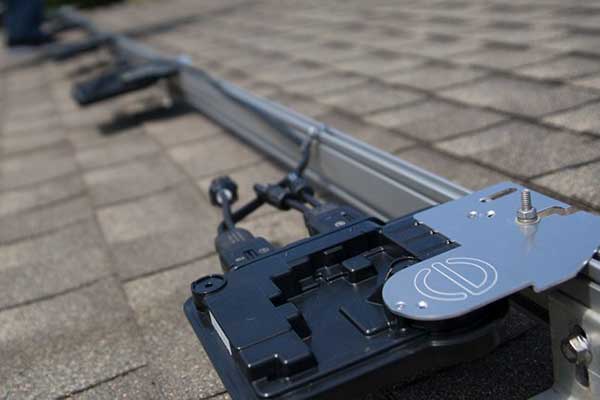

Enphase shipped approximately 677 megawatts DC of its microinverters, or 2,112,725 units, during the quarter. To date, more than 25 million Enphase microinverters have been shipped globally.

The Numbers in Detail

| Metric | 2019 | 2018 | Change |

|---|---|---|---|

| Revenue | $624.3 million | $316.2 million | 97% |

| Gross profit | $221.2 million | $94.4 million | 134% |

| Gross margin | 35.4% | 29.9% | 550 basis points |

| Operating expenses | $118.5 million | $92.8 million | 27% |

| Operating income | $102.7 million | $1.6 million | N/A* |

| Operating margin | 16.4% | 0.5% | N/A* |

| Cash flow from operations | $139.0 million | $16.1 million | 762% |

The company increased revenue by 128% to $210.0 million, compared to $92.3 million in Q4 (2018). The firm noted that in Q4 (2019) GAAP gross margin was 37.1% and non-GAAP gross margin was 37.3%.

Enphase reported “GAAP net income of $116.7 million, including an income tax benefit of $72.2 million; non-GAAP net income of $52.0 million, and GAAP diluted earnings per share (EPS) of $0.88, including an income tax benefit of $0.54; and non-GAAP diluted EPS of $0.39.”

What Comes Next

Enphase expects to ramp up operating expenses throughout 2020 to support the launch of its energy storage products, which will take a bite out of non-GAAP operating margin relative to what has been achieved in recent quarters.

That won’t mark the end of the world, but it’s something for investors to remember when the company’s margin slips in future quarters.

Comments