Panasonic’s new US$4 billion battery factory in De Soto, Kansas, is designed to be a model of sustainability – it’s an all-electric factory with no need for a smokestack. When finished, it will cover the size of 48 football fields, employ 4,000 people and produce enough advanced batteries to supply half a million electric cars per year.

But there’s a catch, and it’s a big one.

While the factory will run on wind and solar power much of the time, renewables supplied only 34% of the local utility Evergy’s electricity in 2023.

In much of the U.S., fossil fuels still play a key role in meeting power demand. In fact, Evergy has asked permission to extend the life of an old coal-fired power plant to meet growing demand, including from the battery factory.

With my students at Wellesley College, I’ve been tracking the boom in investments in clean energy manufacturing and how those projects – including battery, solar panel and wind turbine manufacturing and their supply chains – map onto the nation’s electricity grid.

The Kansas battery plant highlights the challenges ahead as the U.S. scales up production of clean energy technologies and weans itself off fossil fuels. It also illustrates the potential for this industry to accelerate the transition to renewable energy nationwide.

The clean tech manufacturing boom

Let’s start with some good news.

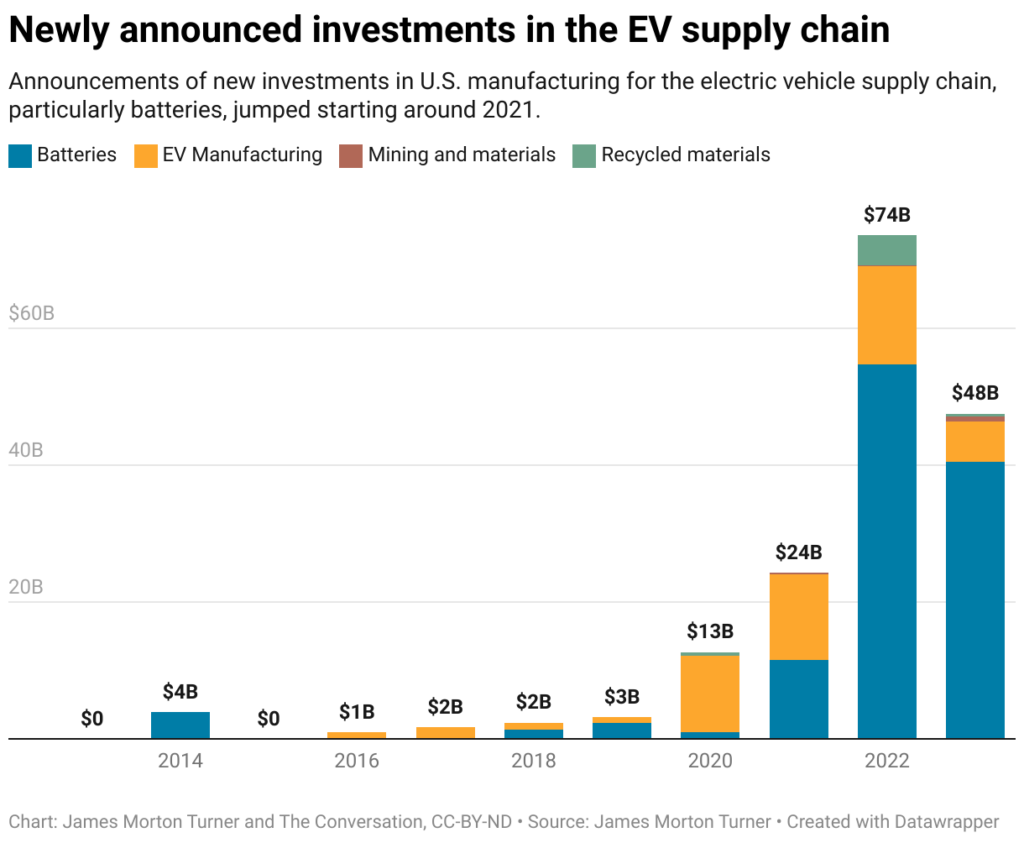

In the battery sector alone, companies have announced plans to build 44 major factories with the potential to produce enough battery cells to supply more than 10 million electric vehicles per year in 2030.

That is the scale of commitment needed if the U.S. is going to tackle climate change and meet its new auto emissions standards announced in March 2024.

The challenge: These battery factories, and the electric vehicles they equip, are going to require a lot of electricity.

Producing enough battery cells to store 1 kilowatt-hour (kWh) of electricity – enough for 2 to 4 miles of range in an EV – requires about 30 kWh of manufacturing energy, according to a recent study.

Combining that estimate and our tracking, we project that in 2030, battery manufacturing in the U.S. would require about 30 billion kWh of electricity per year, assuming the factories run on electricity, like the one in Kansas. That equates to about 2% of all U.S. industrial electricity used in 2022.

Battery belt’s huge solar potential

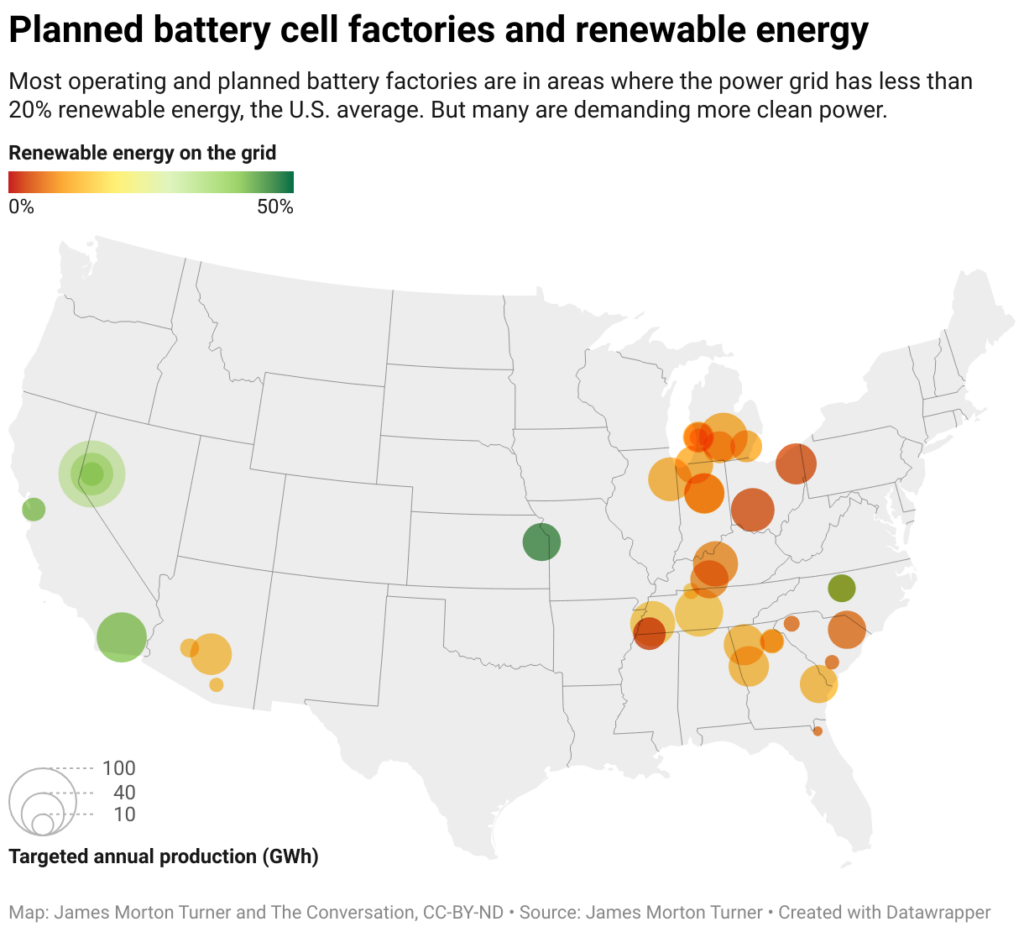

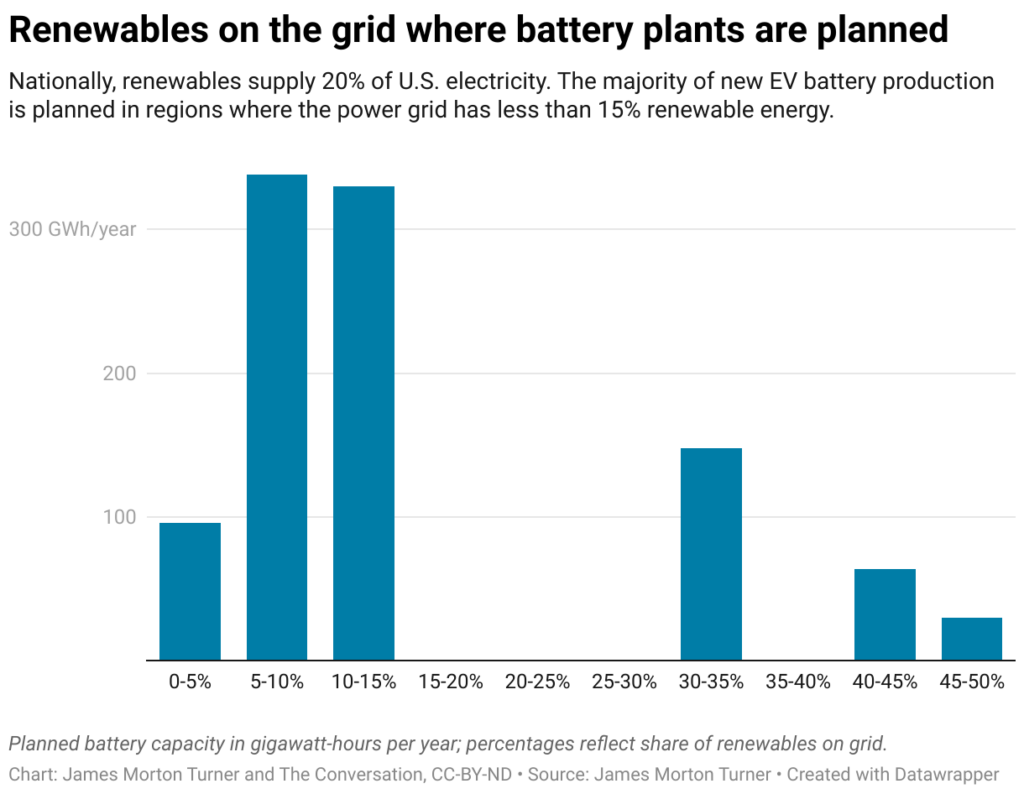

A large number of these plants are planned in a region of the U.S. South dubbed the “battery belt.” Solar energy potential is high in much of the region, but the power grid makes little use of it.

Our tracking found that three-fourths of the battery manufacturing capacity is locating in states with lower-than-average renewable electricity generation today. And in almost all of those places, more demand will drive higher marginal emissions, because that extra power almost always comes from fossil fuels.

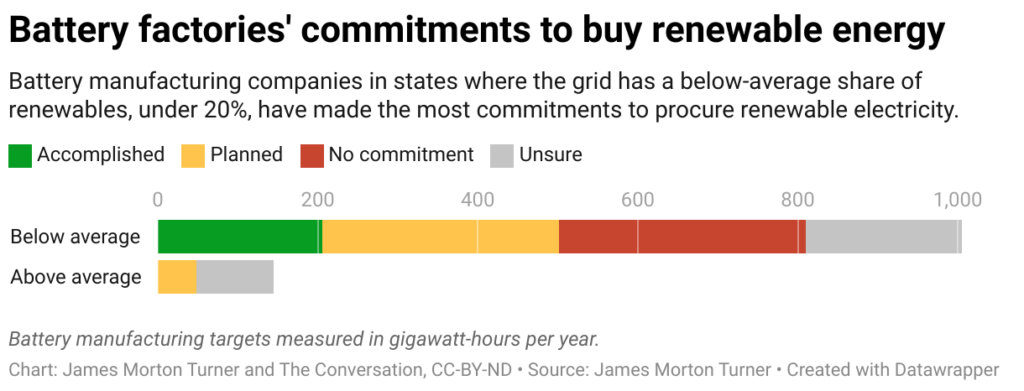

However, we have also been tracking which battery companies are committing to powering their manufacturing operations with renewable electricity, and the data points to a cleaner future.

By our count, half of the batteries will be manufactured at factories that have committed to sourcing at least 50% of their electricity demand from renewables by 2030. Even better, these commitments are concentrated in regions of the U.S. where investments have lagged.

Some companies are already taking action. Tesla is building the world’s largest solar array on the roof of its Texas factory. LG has committed to sourcing 100% renewable solar and hydroelectricity for its new cathode factory in Tennessee. And Panasonic is taking steps to reach net-zero emissions for all of its factories, including the new one in Kansas, by 2030.

More corporate commitments can help strengthen demand for the deployment of wind and solar across the emerging battery belt.

What that means for US electricity demand

Manufacturing all of these batteries and charging all of these electric vehicles is going to put a lot more demand on the power grid. But that isn’t an argument against EVs. Anything that plugs into the grid, whether it is an EV or the factory that manufacturers its batteries, gets cleaner as more renewable energy sources come online.

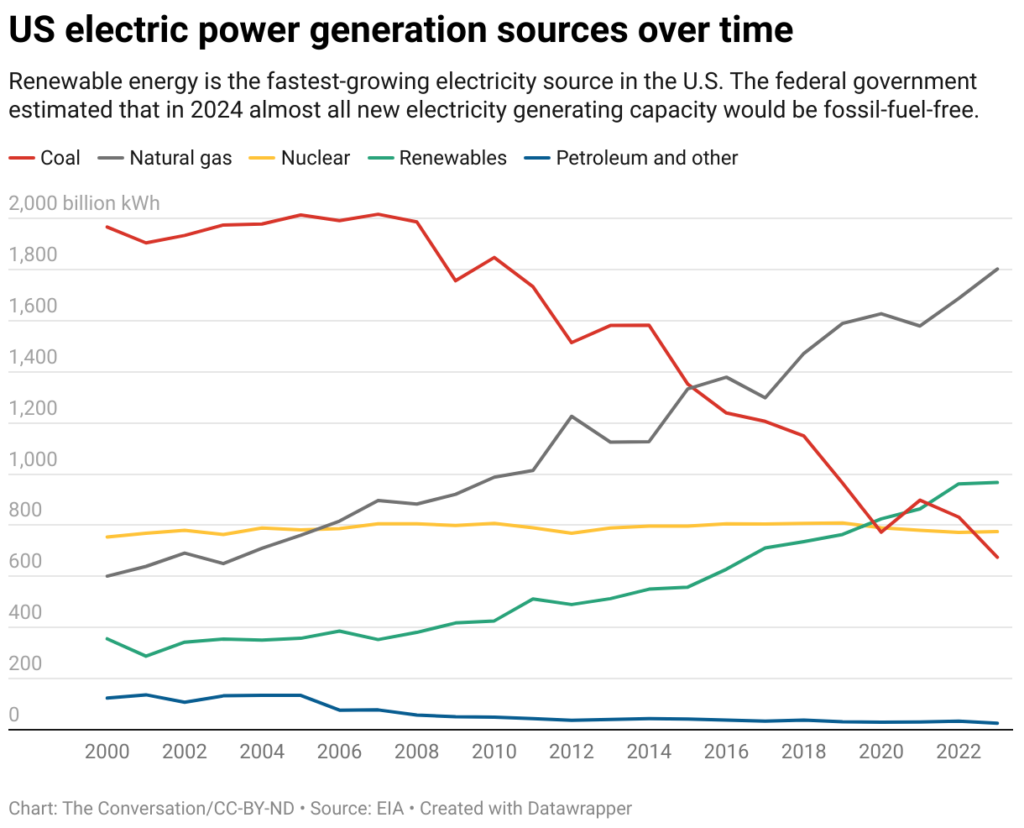

This transition is already happening. Although natural gas dominates electricity generation, in 2023 renewables supplied more electricity than coal for the first time in U.S. history. The government forecasts that in 2024, 96% of new electricity generating capacity added to the grid would be fossil fuel-free, including batteries. These trends are accelerating, thanks to the incentives for clean energy deployment included in the 2022 Inflation Reduction Act.

Looking ahead

The big lesson here is that the challenge in Kansas is not the battery factory – it is the increasingly antiquated electricity grid.

As investments in a clean energy future accelerate, America will need to reengineer much of its power grid to run on more and more renewables and, simultaneously, electrify everything from cars to factories to homes.

That means investing in modernizing, expanding and decarbonizing the electric grid is as important as building new factories or shifting to electric cars.

Investments in clean energy manufacturing will play a key role in enabling that transition: Some of the new advanced batteries will be used on the grid, providing backup energy storage for times when renewable energy generation slows or electricity demand is especially high.

In January, Hawaii replaced its last coal-fired power plant with an advanced battery system. It won’t be long before that starts to happen in Tennessee, Texas and Kansas, too.

—

This article was written by James Morton Turner.

James is an Professor of Environmental Studies, Wellesley College.

It was originally published on The Conversation.

![]()

Comments