Enphase plans on laying off approximately 10% of its global workforce, as revealed in a recent regulatory filing.

This decision comes in the wake of the company’s stock plummeting by 53% this year, primarily due to high interest rates dampening demand and leading to an excess of inventory. Currently, Enphase has a market capitalization of $16.9 billion.

Impact of Market Downturn on Enphase’s Operations

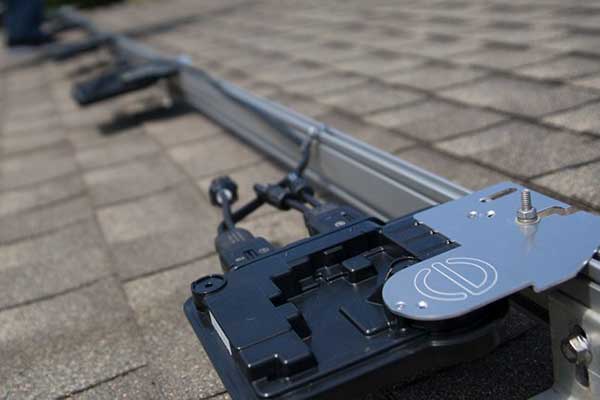

Microinverters, the company’s flagship product, play a crucial role in converting solar energy into usable electricity.

However, the downturn in the solar sector, reflected in the approximately 30% drop in the Invesco Solar ETF (TAN), has significantly impacted Enphase’s operations. This challenging environment has compelled the company to streamline its manufacturing processes.

Enphase Energy is a NASDAQ-listed energy technology company headquartered in Fremont, California. Enphase designs and manufactures software-driven home energy solutions that span solar generation, home energy storage and web-based monitoring and control.

Consequently, Enphase will shut down its contract manufacturing facilities in Wisconsin and Timisoara, Romania, while resizing other contract plants. The focus will now shift to enhancing microinverter production at their South Carolina and Texas facilities.

Financial Implications of the Restructuring Plan

This restructuring will inevitably lead to financial repercussions for Enphase. The company expects to incur between $16 million to $18 million in charges related to restructuring and asset impairment, with the bulk of these costs being accounted for in the fourth quarter of this year.

Challenges in the Broader Solar Industry

The broader context of this decision lies in the overall challenges faced by the solar industry. High interest rates have not only affected consumer demand but have also raised operational costs for solar companies. This situation exemplifies the delicate balance renewable energy companies must maintain in a fluctuating economic landscape.

Enphase’s restructuring, while a direct response to current market conditions, also signals a strategic pivot towards optimizing operations in a less favorable economic climate. It reflects the resilience and adaptability necessary for renewable energy companies to thrive amidst market volatility and changing demand dynamics.

The future of the solar sector, while currently facing headwinds, remains a critical component in the transition to sustainable energy sources.

Comments