- New rules slash the timeline for wind and solar projects to qualify for federal tax credits, with Treasury set to redefine what counts as “beginning construction.”

- Analysts warn up to $373 billion in renewable energy and manufacturing investments are at risk, alongside higher consumer energy costs by 2035.

- Developers of major solar, wind, and manufacturing projects are pausing or reconsidering U.S. investments amid regulatory uncertainty.

Sweeping policy change under President Donald Trump is sending shockwaves through America’s clean energy sector.

As part of a Republican-led budget package, the administration has fast-tracked the phase-out of 30% tax credits for wind and solar projects—credits that previously ran through 2032. Projects must now begin construction within a year or be in service by the end of 2027 to qualify.

In a further blow, Trump directed the Treasury Department to rewrite the rules on what counts as “beginning construction.” For years, developers could claim credits by spending just 5% of project costs and had up to four years to complete construction. That longstanding practice is now under review, with Treasury given 45 days to propose new guidelines—leaving project financing in limbo.

Industry in Disarray

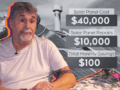

The impact has been immediate. Singapore-based Bila Solar has paused a $20 million expansion at its Indianapolis plant that would have created 75 jobs.

Heliene, a Canadian manufacturer, is reevaluating a $350 million solar cell facility in Minnesota. Norwegian solar wafer producer NorSun is reconsidering its $620 million Tulsa factory. Meanwhile, two fully permitted offshore wind farms—US Wind’s 300 MW Maryland project and Iberdrola’s 791 MW New England Wind project—are now at risk of never breaking ground.

“This is a troubling level of uncertainty,” said Mick McDaniel, Bila Solar’s general manager. Heliene CEO Martin Pochtaruk added, “With so many moving parts, financing of projects, financing of manufacturing is difficult, if not impossible.”

Billions at Stake and Competing Narratives

Analysts are sounding alarms over the broader fallout.

Rhodium Group estimates the new policy endangers $263 billion in planned renewable energy projects and $110 billion in manufacturing investments.

Consulting firm ICF projects a 25% increase in U.S. electricity demand by 2030, driven largely by AI and cloud computing. A restricted pipeline of renewable projects could lead to tighter power supplies and push household electricity bills up by $280 annually by 2035, according to Princeton’s REPEAT Project.

The Trump administration argues that rapid adoption of renewables has destabilized the grid and increased consumer costs—a claim widely contested by energy experts, who point to states like Texas, where renewables have helped reduce wholesale power prices.

Yet, with U.S. energy demand surging, even industry representatives supportive of fossil fuels warn against curbing clean energy growth. “All new generation—renewables and fossil—must be encouraged to meet the coming demand,” one power sector official told Bloomberg.

Shrinking Window

Wood Mackenzie forecasts a 17% drop in solar installations and 20% decline in wind projects over the next decade. The consultancy also warns that offshore wind, already grappling with inflation and supply chain disruptions, may not recover without substantial policy support.

For now, developers are scrambling to break ground before incentives vanish. But the uncertainty surrounding Treasury’s revised rules may make even that strategy unviable.

Perspective

The clean energy sector has been one of the fastest-growing parts of the U.S. economy, buoyed by tax credits designed to attract billions in private capital and create thousands of jobs. Gutting these incentives risks stalling that momentum at a critical time—just as demand for electricity is set to soar.

If the U.S. intends to remain competitive in AI, advanced manufacturing, and grid modernization, policymakers may need to rethink whether a sharp retreat from renewable subsidies aligns with long-term economic and energy security goals.

Comments