Michigan — Rocket Companies announced it is launching into the solar energy industry.

The company will be leveraging the same technology, data and client experience that has revolutionized the mortgage, real estate and personal lending spaces to help Americans make their home more energy-efficient.

Rocket Companies’ opportunity in green home energy solutions is vast, with the solar industry at a growth inflection point. There have been more than 2 million solar installations in the U.S., with panel installation reaching a record high in 2020, according to a joint study released earlier this year by the Solar Energy Industries Association and Wood Mackenzie.

The study also reports that the solar market in the country is expected to quadruple by 2030, with roughly one in eight American homes having solar energy by that year.

“Rocket Companies is uniquely positioned to build trust and education in solar energy, simplifying the entire process through our platform. We have the technology and expertise to provide the best experience possible for homeowners who want to go green,” said Jay Farner, Vice Chairman and CEO of Rocket Companies. “This is a perfect synergy between our businesses as we develop a digital solution to ensure Americans can receive solar panels with the same certainty they have come to expect when working with our Rocket platforms.”

The company’s Rocket Cloud Force will serve as solar advisors, a dedicated group of team members with extensive training in the industry. The team members will help clients determine if solar panels are the best choice for their home. They will then connect homeowners to a simple, digital financing application. Once financing is handled, the Rocket Cloud Force will facilitate the installation of a new solar solution.

These new solar offerings will start in the testing phase in fourth quarter and are expected to be available to the public in early 2022.

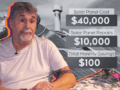

As Rocket Companies’ first step into green energy, Rocket Mortgage – America’s largest mortgage lender – is immediately releasing a new rate-and-term refinance giving homeowners the ability to consolidate any solar panel loan with their mortgage for one low-interest rate. This program has an advantage over traditional cash-out refinances since rate-and-term mortgages provide significantly more flexible guidelines than a cash-out, including a loan-to-value (LTV) ratio as high as 97 percent.

This new loan option from Rocket Mortgage is crucial for anyone who has an outstanding solar loan. Beyond the lower interest rate, this new mortgage program also gives homeowners the ability to leverage the full value of their existing federal solar Investment Tax Credit (ITC) and any other local tax credits they may qualify for.

Comments