- If Canada were to develop a federal solar incentive program as part of its post-pandemic recovery — what would it look like?

- The U.S version of the ITC has provided stability for cleantech innovators and investors. It has helped create thousands of jobs and pushed electricity costs down by driving market competition.

- Here is how Canada can create and effectively implement a solar incentive program.

In just a few short months, the coronavirus pandemic has profoundly destabilized the world’s economies and brought on a devastating recession sure to have lasting impacts. Governments around the world have scrambled to unload a tsunami of expenditures and programs to avoid economic collapse.

Where countries choose to direct this expenditure will have serious structural and economic implications moving forward, heightening the pressure on incumbent governments to make the right decisions.

Canada’s Liberal Party has been applauded for its response to Covid-19, which has prioritized public health over reopening the economy. As a direct result, Canada has experienced less economic turmoil than other nations and has successfully flattened the country’s curve. In contrast, the United States disregarded expert opinion, sought to prioritize the economy over public health, and has subsequently failed on both fronts.

The Liberal post-pandemic recovery plan has been far from perfect.

Investments in cleantech are not close to being on par with fossil fuels, which creates a rift between Liberal platform policy and actual government policy. This is happening today, despite the opportunity to rapidly decarbonize, thanks to low-interest rates and the public’s willingness to allow governments to spend seemingly endless amounts of money for recovery.

Solar energy technology presents an incredible opportunity for cleantech investment that creates immediate jobs and promotes climate change mitigation. For ideas on how to support this industry, Trudeau’s Liberals should look south of the border at the American solar investment tax credit (ITC).

The federal government provides a solar tax credit, known as the investment tax credit (ITC), that allow homeowners and businesses to deduct a portion of their solar costs from their taxes.

The ITC is a federal policy mechanism that encourages the production of solar energy in the United States. It offers a rebate for solar installations that can be applied dollar for dollar towards an individual’s income tax.

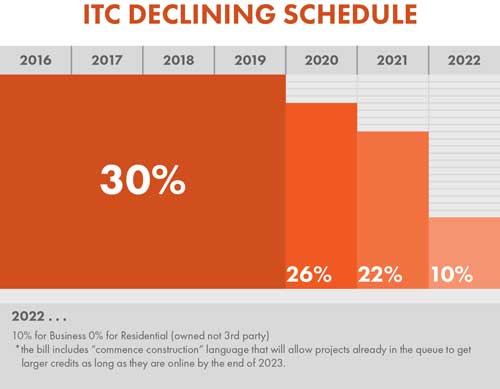

The ITC is a 26 percent tax credit for solar systems on residential and commercial properties. The commercial credit can be applied to both customer-sited commercial solar systems and large-scale utility solar farms.

Since the ITC’s enactment in 2006, the American solar industry has grown by more than 10,000 percent (52 percent on average annual) creating hundreds of thousands of jobs and investing billions of dollars in the U.S. economy.

Continued renewal of the ITC has provided stability for cleantech innovators and investors, creating jobs, and helping to lower electricity costs by driving market competition. The ITC is an excellent example of a public policy success story, with solar energy now making up 2.5 percent of energy production across the United States.

This is well above Canada, which garners 0.5 percent of its electricity from solar power.

A vital strength of the U.S version of the ITC is that it’s a federally administered program, allowing any homeowner or business to take advantage of it without the usual complications involved with local state politics. This has permitted solar production to bypass partisan and ideological concerns that would harm the industry’s growth.

Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates. The timeline for the eventual end of the ITC is in 2022.

In Canada, unfortunately, solar incentives have not been able to bypass many provincial political arenas with success. Clean energy incentives are up to the discretion of each province, which has provided relatively little stability for the industry and made the production of solar energy far more partisan than it should be.

Ontario is an excellent example of this. Before the 2018 provincial election (which saw Doug Ford’s Conservatives win), the Liberal government of Ontario, under the leadership of Kathleen Wynne, aggressively pushed solar incentives. Wynne’s government developed the MicroFIT program, which subsidized solar production on residential properties above market rates.

Unfortunately, the design of the program made it easy to abuse. The program cost billions of dollars because of long-term contracts, while only providing roughly 0.3 percent of Ontario’s electricity generation. After the Liberal defeat in 2018, all solar and green energy incentives were terminated, severely damaging Ontario’s clean energy market.

While the MicroFIT program ultimately failed, it demonstrated how incentives are capable of electrifying the solar market. This principle should be applied at the federal level to boost the demand for cleantech in every province, regardless of political culture.

Trudeau’s Liberal Party may not be as green as they’ve lead on, but legislating a Pan-Canada solar incentive framework would significantly improve their track record on environmental initiatives.

Internal disagreements between Finance Minister Morneau and Prime Minister Trudeau about the scope of funding for green projects have recently come to light. It highlights the growing focus within the Liberal Party to address climate change and other environmental challenges.

Trudeau has argued in favor of more spending for green projects, whereas Morneau has opposed such measures, deeming them too costly. On this issue, Trudeau’s intuition is serving him well.

Adopting a Canada-wide solar incentive would make for an incredibly efficient investment strategy for a post-pandemic recovery, as it would accomplish a myriad of social, economic, and environmental goals.

Aerial view of a Net-Zero home (Photo courtesy Reid’s Heritage Homes) Net-zero homes only use as much electricity as is produced from on-site renewables.

First and foremost, a federal solar incentive would boost the demand for cleantech in Canada, creating thousands of much-needed jobs in the process. A federal solar incentive would also increase the share of renewable energy in Canada’s electricity mix. It will also boost the development of net-zero homes supporting a recently announced housing plan by the federal government.

Net-zero homes are so energy efficient, they only use as much electricity as is produced from on-site renewables. This policy would help Canada progress towards achieving its goals under the Paris Climate Accord to reduce emissions by 30 percent of 1990 levels by 2030. Trudeau’s Liberals have repeatedly said that they’re on track to meet this goal; however, this claim is misleading.

Finally, a national solar incentive would improve community health, wellness and help promote energy independence.

How would such a program be administered?

Designing and administering such a comprehensive policy would be highly problematic. Existing organizations, such as the Independent Electricity System Operator (IESO) in Ontario, are already plagued by internal complexities and bureaucracy, making them less suitable for handling such a policy.

As such, it would be best to deliver this incentive through a new independent government agency. The independent agency would ideally be responsible for administering the program, certifying and monitoring companies performing solar installations, developing regulations for the solar industry, and ensuring compliance.

The coronavirus pandemic has provided an excellent opportunity for world leaders to make great strides in fighting climate change. A federal solar incentive program would make for a worthy initiative — as part of a post-pandemic recovery plan — as it would provide thousands of jobs and give homeowners a way to reduce their bills, improve their health, and fight climate change. It would be a shame should the Liberals pass up on this opportunity.

Comments